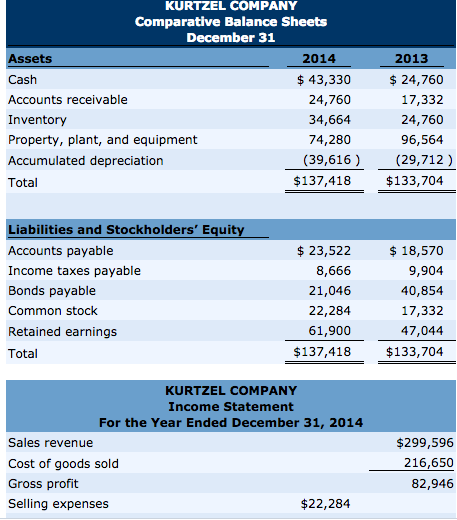

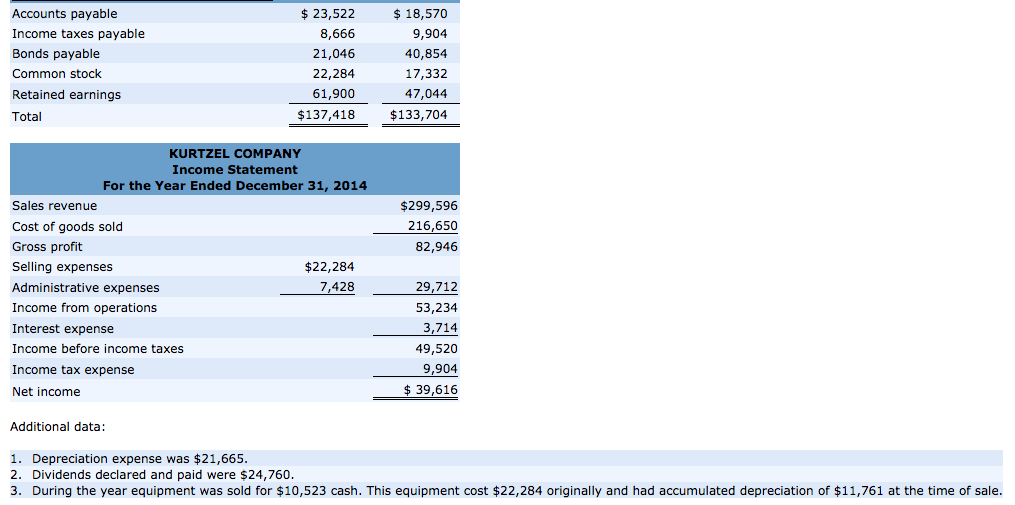

Question: Compute these cash-based measures: (1) Current cash debt coverage. (2) Cash debt coverage. (3) Free cash flow. KURTZEL COMPANY Comparative Balance Sheets December 31 2013

Compute these cash-based measures:

(1) Current cash debt coverage.

(2) Cash debt coverage.

(3) Free cash flow.

KURTZEL COMPANY Comparative Balance Sheets December 31 2013 Assets 2014 43,330 24,760 Cash 17,332 Accounts receivable 24,760 Inventory 34,664 24,760 Property, plant, and equipment 74,280 96,564 (39,616) (29,712) Accumulated depreciation $137,418 $133,704 Total Liabilities and Stockholders' Equity 23,522 18,570 Accounts payable 9,904 Income taxes payable 8,666 Bonds payable 40,854 21,046 17,332 Common stock 22,284 61,900 47,044 Retained earnings $137,418 $133,704 Tota KURTZEL COMPANY Income Statement For the Year Ended December 31, 2014 $299,596 Sales revenue 216,650 Cost of goods sold Gross profit 82,946 $22,284 Selling expenses

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts