Question: compute these ratios: Current Quick Total Asset Turnover Inventory Turnover Debt Interest Coverage Net Profit Margin ROE Market Value Price to Earning PLEASE SHOW WORK

compute these ratios:

Current

Quick

Total Asset Turnover

Inventory Turnover

Debt

Interest Coverage

Net Profit Margin

ROE

Market Value

Price to Earning

PLEASE SHOW WORK

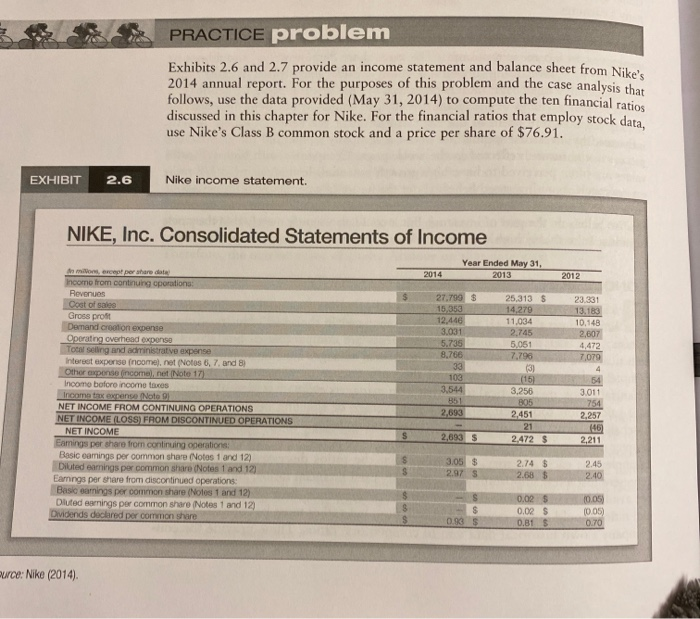

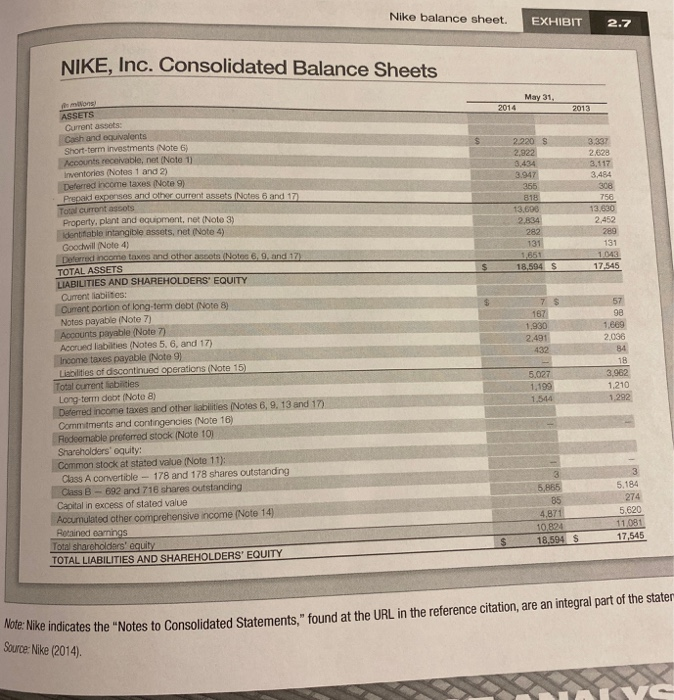

PRACTICE problem Exhibits 2.6 and 2.7 provide an income statement and balance sheet from Nike 2014 annual report. For the purposes of this problem and the case analysis that follows, use the data provided (May 31, 2014) to compute the ten financial ratios discussed in this chapter for Nike. For the financial ratios that employ stock data use Nike's Class B common stock and a price per share of $76.91. EXHIBIT 2.6 Nike income statement. NIKE, Inc. Consolidated Statements of Income Year Ended May 31, 2012 27.799 $ 15.353 124446 3.031 25,313 14.279 11.034 2,745 5.051 7.796 23.331 13.183 10.148 2007 4.AT 7 079 8.766 33 103 1544 (151 3.256 3.011 except per here home from continuing operations: Revenues Cost of Gross profit Demand creation expense Operating overed expense Tot selling and administrative expense Interest expense income, ret (Notos , 7 and 8) Other exponse incomel, net Note 17) Income before income faces romeone NET INCOME FROM CONTINUING OPERATIONS NET INCOME (LOSS FROM DISCONTINUED OPERATIONS NET INCOME Eamings per share from continuing operations: Basic comings per common share (Notes 1 and 12) Diluted comings per common share Notes and 12 Earings per share from discontinued operations: Basi carings per common share (Nolos 1 and 12) Diluted earnings per common share Notes 1 and 12) Didends declared per common share 05 754 2,693 2,451 21 2.257 46 2,211 $ 2,693 S 2.4725 2.45 3.05 $ 2.975 2.74 $ 2.685 240 - 0.025 S S 0.02 0.05 005 0.70 0.81 urce: Nike (2014) Nike balance sheet. | EXHIBIT 2.7 NIKE, Inc. Consolidated Balance Sheets 2220 S 2.922 3337 2.628 3.947 3.484 B1R 758 1360 2.452 282 131 1043 1 504 $ 17.545 S ASSETS Curront assets Cash and equivalents Short-term investments Note 6) Accounts receivable, not (Note 1) inventories Notes 1 and 2) Deferred income taxes (Note 9) Prepaid expenses and other current asts Ncs and 173 Total current assots Property, plant and equipment, net ( Note 3) dettable intangible assets.net Note 4) Goodwill Note 4) di income taxes and other and 17 TOTAL ASSETS LIABILITIES AND SHAREHOLDERS' EQUITY Current liabiles: Current portion of long-term debt (Note 8) Notes payable Note 7) Accounts payable (Note 77 Accrued liabilities (Notes 5. 6, and 17) Income taxes payable (Note 9 Libilities of discontinued operations Note 15) Total current faibles Long-term dobt (Note 8) Deferred income taxes and other abities Notes 6. 9. 13 and 17) Commitments and contingencies (Note 16) Rodeemable preferred stock (Note 10) Shareholders' oquity: Common stock at stated value (Note 11); Class A convertible - 178 and 178 shares outstanding Class B - 692 and 716 shares outstanding Capital in excess of stated value Accumulated other comprehensive Income (Note 14 Reained earings Total shareholders' equity TOTAL LIABILITIES AND SHAREHOLDERS' EQUITY 7 167 1.930 2491 432 1069 2.036 84 5027 1,199 1544 30 1.210 1.202 5,865 85 4,871 10824 18,594 5.184 274 5.620 1 1081 17,545 S ndicates the "Notes to Consolidated Statements," found at the URL in the reference citation, are an integral part of the stater use: Nike (2014)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts