Question: Computer Assignment #1 (ProFile Tax Software). CPU Assignment 1: The CPU assignment 1 is worth 15% of your overall grade in this course. This assignment

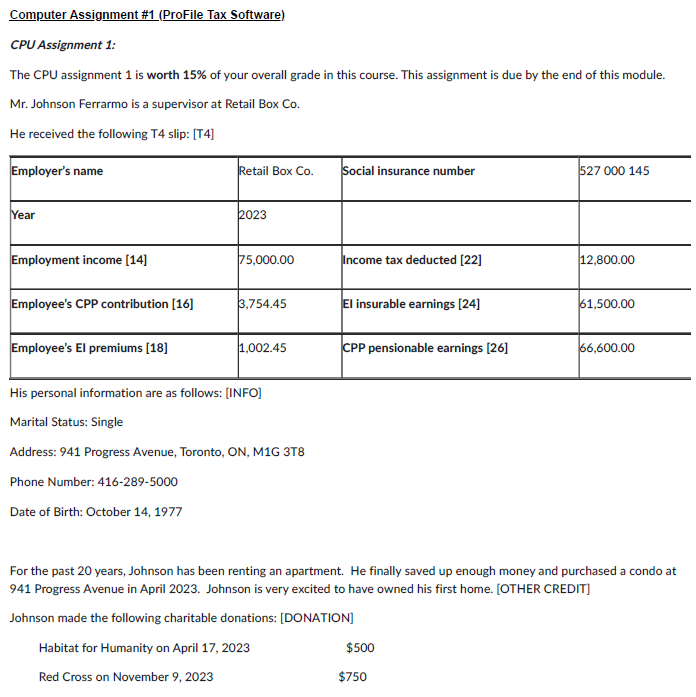

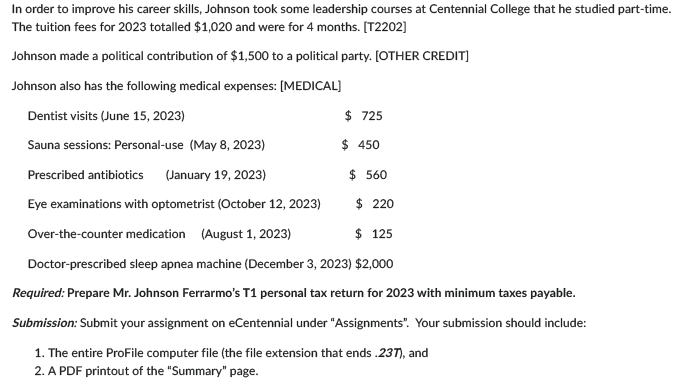

Computer Assignment \#1 (ProFile Tax Software). CPU Assignment 1: The CPU assignment 1 is worth 15% of your overall grade in this course. This assignment is due by the end of this module. Mr. Johnson Ferrarmo is a supervisor at Retail Box Co. He received the following T4 slip: [T4] His personal information are as follows: [INFO] Marital Status: Single Address: 941 Progress Avenue, Toronto, ON, M1G 3T8 Phone Number: 416-289-5000 Date of Birth: October 14, 1977 For the past 20 years, Johnson has been renting an apartment. He finally saved up enough money and purchased a condo at 941 Progress Avenue in April 2023. Johnson is very excited to have owned his first home. [OTHER CREDIT] Johnson made the following charitable donations: [DONATION] In order to improve his career skills, Johnson took some leadership courses at Centennial College that he studied part-time. The tuition fees for 2023 totalled $1,020 and were for 4 months. [T2202] Johnson made a political contribution of $1,500 to a political party. [OTHER CREDIT] Johnson also has the following medical expenses: [MEDICAL] Required: Prepare Mr. Johnson Ferrarmo's T1 personal tax return for 2023 with minimum taxes payable. Submission: Submit your assignment on eCentennial under "Assignments". Your submission should include: 1. The entire ProFile computer file (the file extension that ends.23T), and 2. A PDF printout of the "Summary" page

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts