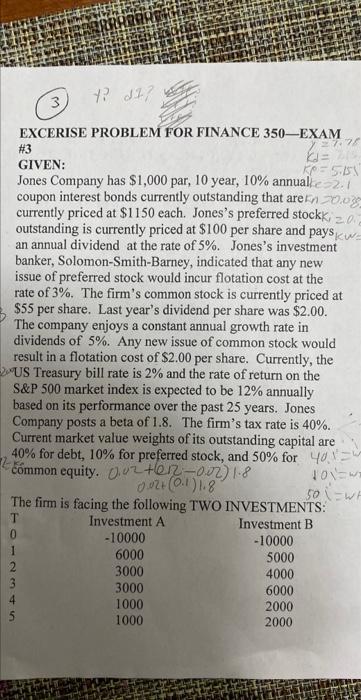

Question: Computer Y, Kd, Kp, Ke, Kn, Ki(Using CAPM), and Kw using Ke as the cost of common equity. For investment A and investment B find:

HXCRRISE PROATEM FCMR HINANCE 150-RNAM m3 GIVTY: Fones Coenpart ham 51,000 par, 10 y zar, 10\%t annual compod intereat bends catratly cutstandine that afe curtenty priced at 5, 150 each. Woces's pecferted atock ouncanding is curcnily feiced at 5100 ger share and poys an menal dividend at the rate of 5 to. Jobes's imeilttert bubker, 50 oonob-Smith-Bseray, indicated that iny new issie of pecicrod Mork would inkur llogetion oont at the fine of the. The firm's comimon stock is cumendy priced at $55 pot share. 1 art ycar's thvidend per thafe was 52.00 The cempary engibs dicocstant annual susth rwe in dividends of ST. Amy new isget of cootnon sheck would rerult in a flotation coit of 52.00 per shate. Cumetty, the 45 Treasury bill tale is zh ast the rate of roturn ce the Sxp 500) matket inden is copected to be 125 anfully baced bh its ferflormance over the paie 25 years. Fonev Compary posts a beta of 1.8 . The firm's 1 ax rate is 40 . Cument marlvet value welphts of its outhanding capital are syla for debl, I0Nh fod preferred slock, and den i foe comment bquity. 3) EXCERISE PROBLEM FOR FINANCE 350-EXAM H3 GIVEN: Jones Company has $1,000 par, 10 year, 10% annuale =2.15 coupon interest bonds currently outstanding that are n=0.038 currently priced at $1150 each. Jones's preferred stockk, outstanding is currently priced at $100 per share and pays an annual dividend at the rate of 5%. Jones's investment banker, Solomon-Smith-Barney, indicated that any new issue of preferred stock would incur flotation cost at the rate of 3%. The firm's common stock is currently priced at $55 per share. Last year's dividend per share was $2.00. The company enjoys a constant annual growth rate in dividends of 5%. Any new issue of common stock would result in a flotation cost of $2.00 per share. Currently, the US Treasury bill rate is 2% and the rate of return on the S\&P 500 market index is expected to be 12% annually based on its performance over the past 25 years. Jones Company posts a beta of 1.8 . The firm's tax rate is 40%. Current market value weights of its outstanding capital are 40% for debt, 10% for preferred stock, and 50% for cmmon equity. The firm is facing the following TWO INVESTMENTS: HXCRRISE PROATEM FCMR HINANCE 150-RNAM m3 GIVTY: Fones Coenpart ham 51,000 par, 10 y zar, 10\%t annual compod intereat bends catratly cutstandine that afe curtenty priced at 5, 150 each. Woces's pecferted atock ouncanding is curcnily feiced at 5100 ger share and poys an menal dividend at the rate of 5 to. Jobes's imeilttert bubker, 50 oonob-Smith-Bseray, indicated that iny new issie of pecicrod Mork would inkur llogetion oont at the fine of the. The firm's comimon stock is cumendy priced at $55 pot share. 1 art ycar's thvidend per thafe was 52.00 The cempary engibs dicocstant annual susth rwe in dividends of ST. Amy new isget of cootnon sheck would rerult in a flotation coit of 52.00 per shate. Cumetty, the 45 Treasury bill tale is zh ast the rate of roturn ce the Sxp 500) matket inden is copected to be 125 anfully baced bh its ferflormance over the paie 25 years. Fonev Compary posts a beta of 1.8 . The firm's 1 ax rate is 40 . Cument marlvet value welphts of its outhanding capital are syla for debl, I0Nh fod preferred slock, and den i foe comment bquity. 3) EXCERISE PROBLEM FOR FINANCE 350-EXAM H3 GIVEN: Jones Company has $1,000 par, 10 year, 10% annuale =2.15 coupon interest bonds currently outstanding that are n=0.038 currently priced at $1150 each. Jones's preferred stockk, outstanding is currently priced at $100 per share and pays an annual dividend at the rate of 5%. Jones's investment banker, Solomon-Smith-Barney, indicated that any new issue of preferred stock would incur flotation cost at the rate of 3%. The firm's common stock is currently priced at $55 per share. Last year's dividend per share was $2.00. The company enjoys a constant annual growth rate in dividends of 5%. Any new issue of common stock would result in a flotation cost of $2.00 per share. Currently, the US Treasury bill rate is 2% and the rate of return on the S\&P 500 market index is expected to be 12% annually based on its performance over the past 25 years. Jones Company posts a beta of 1.8 . The firm's tax rate is 40%. Current market value weights of its outstanding capital are 40% for debt, 10% for preferred stock, and 50% for cmmon equity. The firm is facing the following TWO INVESTMENTS

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts