Question: Computer-based central office electronic switching for telephone and data use has an installed cost of $300,000. It is in the MACRSGDS 5-year property class. Upon

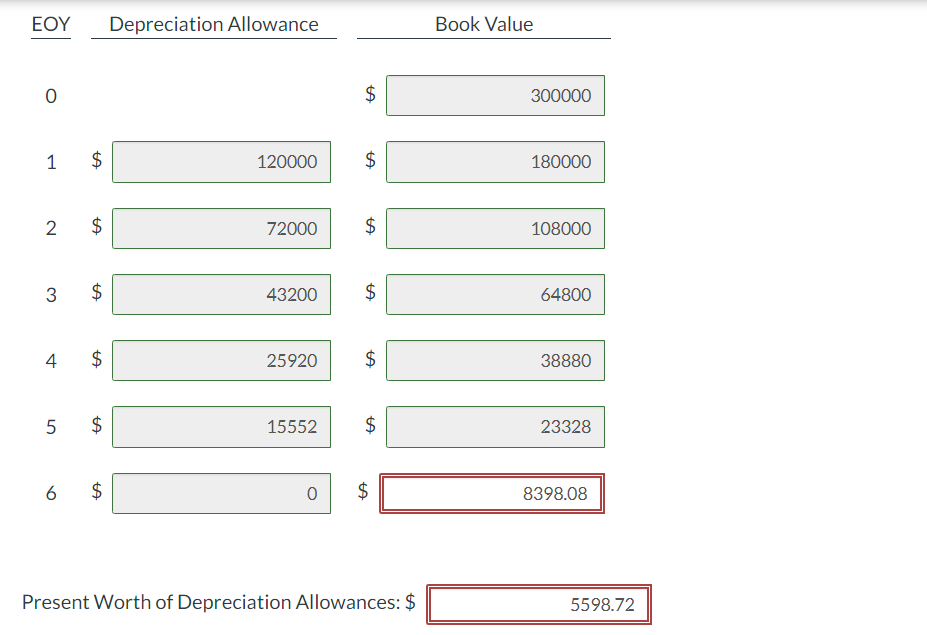

Computer-based central office electronic switching for telephone and data use has an installed cost of $300,000. It is in the MACRSGDS 5-year property class. Upon disposal, the equipment will be given away in return for dismantling and moving it, resulting in a net $0 salvage. Compare MACRS to traditional depreciation methods by calculating yearly depreciation allowances, present worth of the depreciation allowances, and book value for each year using each of the following. MARR is 10%. EOY Depreciation Allowance Book Value 0 $300000 1 $180000 2$ 72000 $ 108000 3$ 43200 $64800 4$ 25920 $ 38880 5$ 15552 $ 23328 6 $0 Present Worth of Depreciation Allowances: \$ 5598.72

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts