Question: Computerized Accounting Question urgently need help with this Payroll Question: The supervisor of Planet Fit Garment Ltd has prepared the following report of the time

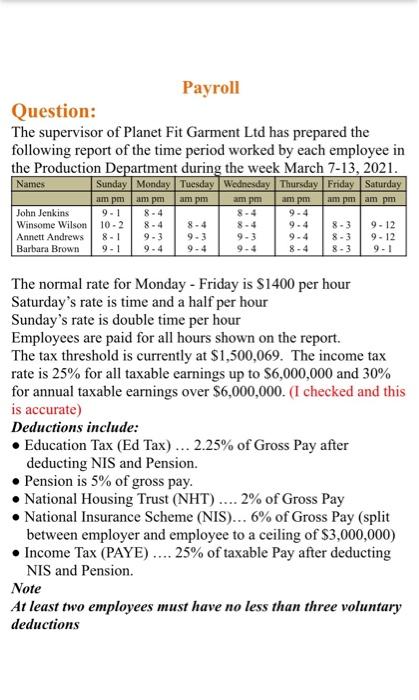

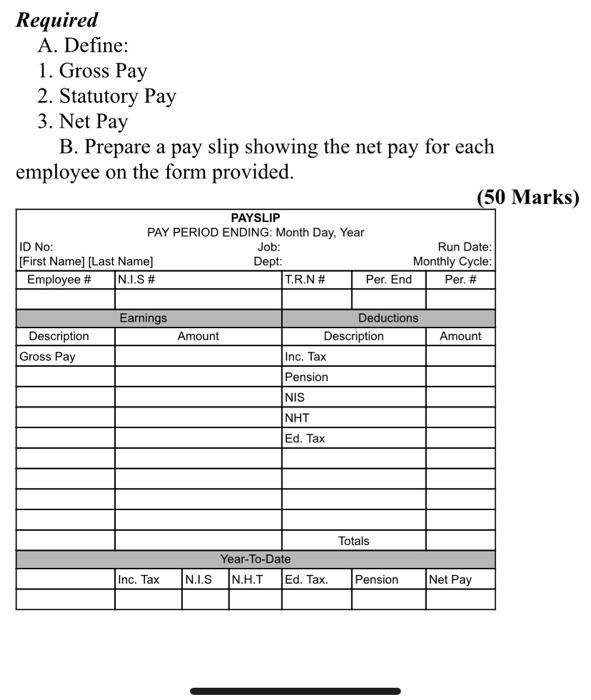

Payroll Question: The supervisor of Planet Fit Garment Ltd has prepared the following report of the time period worked by each employee in the Production Department during the week March 7-13, 2021. Names Sunday Monday Tuesday Wednesday Thursday Friday Saturday am pm am pm am pm am pm am pm am pm am pm John Jenkins 9-1 8-4 8-4 9-4 Winsome Wilson 10-2 8-4 8-4 8-4 9-4 8-3 9-12 Annett Andrews 8-1 9-3 9-3 9-3 9-4 8-3 9-12 Barbara Brown 9-1 9-4 9-4 9-4 8-4 8-3 9-1 The normal rate for Monday - Friday is $1400 per hour Saturday's rate is time and a half per hour Sunday's rate is double time per hour Employees are paid for all hours shown on the report. The tax threshold is currently at $1,500,069. The income tax rate is 25% for all taxable earnings up to $6,000,000 and 30% for annual taxable earnings over $6,000,000. (I checked and this is accurate) Deductions include: Education Tax (Ed Tax) ... 2.25% of Gross Pay after deducting NIS and Pension. Pension is 5% of gross pay. National Housing Trust (NHT).... 2% of Gross Pay National Insurance Scheme (NIS)... 6% of Gross Pay (split between employer and employee to a ceiling of $3,000,000) Income Tax (PAYE).... 25% of taxable Pay after deducting NIS and Pension. Note At least two employees must have no less than three voluntary deductions Required A. Define: 1. Gross Pay 2. Statutory Pay 3. Net Pay B. Prepare a pay slip showing the net pay for each employee on the form provided. PAYSLIP PAY PERIOD ENDING: Month Day, Year Job: ID No: Dept: [First Name] [Last Name] N.I.S # Employee # T.R.N # Earnings Description Amount Inc. Tax Pension NIS NHT Ed. Tax Gross Pay Description Year-To-Date Inc. Tax N.I.S N.H.T Ed. Tax. Per. End Deductions Totals Pension Run Date: Monthly Cycle: Per. # Amount (50 Marks) Net Pay

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts