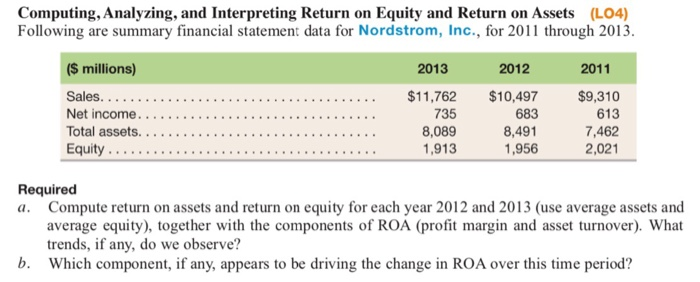

Question: Computing, Analyzing, and Interpreting Return on Equity and Return on Assets (L04) Following are summary financial statement data for Nordstrom, Inc., for 2011 through 2013.

Computing, Analyzing, and Interpreting Return on Equity and Return on Assets (L04) Following are summary financial statement data for Nordstrom, Inc., for 2011 through 2013. ($ millions) Sales................. Net income........................... Total assets.............. Equity................ ............ ..................... .. 2013 2012 2011 $11,762 $10,497 $9,310 735 683 613 8,0898,4917,462 1,913 1,956 2,021 Equity Required a. Compute return on assets and return on equity for each year 2012 and 2013 (use average assets and average equity), together with the components of ROA (profit margin and asset turnover). What trends, if any, do we observe? b. Which component, if any, appears to be driving the change in ROA over this time period

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts