Question: Computing and Analyzing a LIFO Liquidation Chide's storage facility was shut down due to a strike in December 2020, resulting in a drastic reduction in

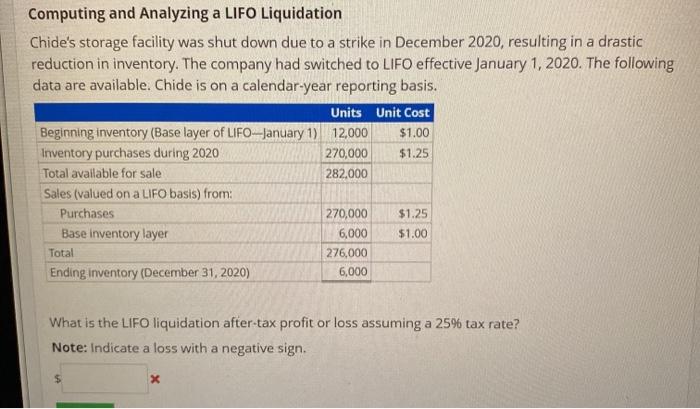

Computing and Analyzing a LIFO Liquidation Chide's storage facility was shut down due to a strike in December 2020, resulting in a drastic reduction in inventory. The company had switched to LIFO effective January 1, 2020. The following data are available. Chide is on a calendar-year reporting basis. Units Unit Cost Beginning inventory (Base layer of LIFO--January 1) 12,000 $1.00 Inventory purchases during 2020 270,000 $1.25 Total available for sale 282,000 Sales (valued on a LIFO basis) from: Purchases 270,000 $1.25 Base inventory layer 6,000 276,000 Ending inventory (December 31, 2020) 6,000 $1.00 Total What is the LIFO liquidation after-tax profit or loss assuming a 25% tax rate? Note: Indicate a loss with a negative sign. X

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts