Question: Computing and Recording Depletion Expense In 2016, Eldenburg Mining Company purchased land for $5,760,000 that had a natural resource reserve estimated to be 500,000 tons.

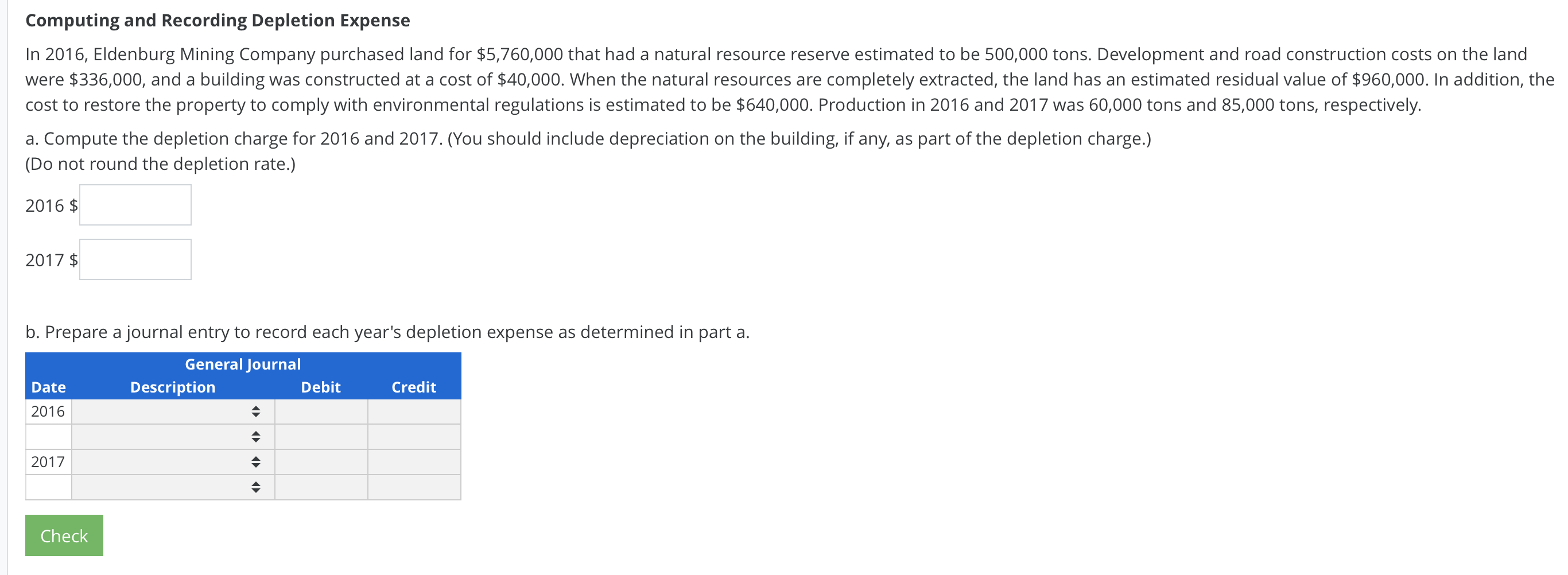

Computing and Recording Depletion Expense In 2016, Eldenburg Mining Company purchased land for $5,760,000 that had a natural resource reserve estimated to be 500,000 tons. Development and road construction costs on the land were $336,000, and a building was constructed at a cost of $40,000. When the natural resources are completely extracted, the land has an estimated residual value of $960,000. In addition, the cost to restore the property to comply with environmental regulations is estimated to be $640,000. Production in 2016 and 2017 was 60,000 tons and 85,000 tons, respectively. a. Compute the depletion charge for 2016 and 2017. (You should include depreciation on the building, if any, as part of the depletion charge.) (Do not round the depletion rate.) 2016 $ 2017 $ b. Prepare a journal entry to record each year's depletion expense as determined in part a. General Journal Date Description Debit Credit 2016 2017 . Check

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts