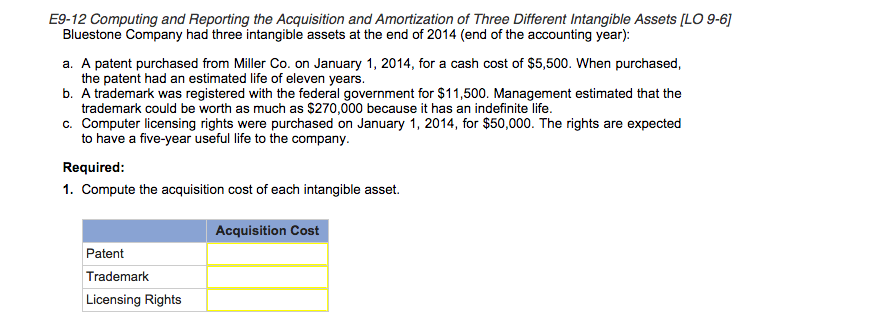

Question: Computing and Reporting the Acquisition and Amortization of Three Different Intangible Assets [LO 9-6] Bluestone Company had three intangible assets at the end of 2014

![Assets [LO 9-6] Bluestone Company had three intangible assets at the end](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/09/66e939d3f18db_72366e939d3925da.jpg)

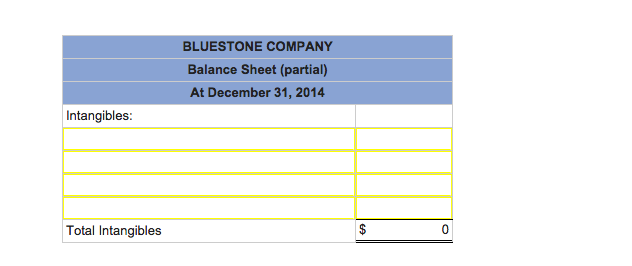

Computing and Reporting the Acquisition and Amortization of Three Different Intangible Assets [LO 9-6] Bluestone Company had three intangible assets at the end of 2014 (end of the accounting year): A patent purchased from Miller Co. on January 1, 2014, for a cash cost of $5,500. When purchased, the patent had an estimated life of eleven years. A trademark was registered with the federal government for $11,500. Management estimated that the trademark could be worth as much as $270,000 because it has an indefinite life. Computer licensing rights were purchased on January 1, 2014, for $50,000. The rights are expected to have a five-year useful life to the company. Compute the acquisition cost of each intangible asset

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts