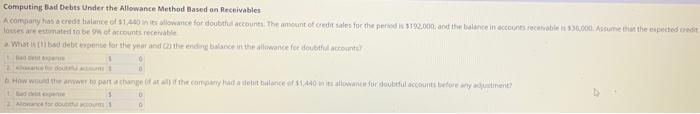

Question: Computing Bad Debts Under the Allowance Method Based on Receivables A company has a credit balance of 1.440 towance for doubtful accounts Thement of credits

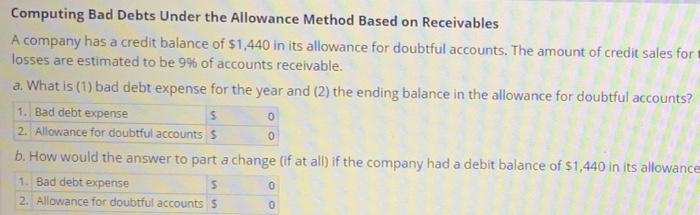

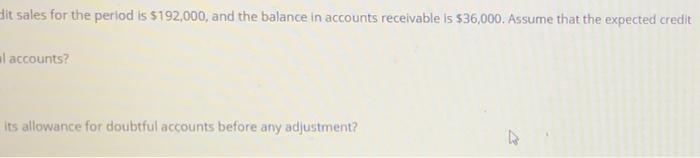

Computing Bad Debts Under the Allowance Method Based on Receivables A company has a credit balance of 1.440 towance for doubtful accounts Thement of credits for the period is 192,000, and the balance in accounts receivable 330.000. Assume that the cented credit lous weesmated to be on accounts recent What is the bad debt pente for the year and the ending once in the alliance for doints 1 0 How we are to part achat the company atlebitance of 14 mwance for doubt accounts before went Computing Bad Debts Under the Allowance Method Based on Receivables A company has a credit balance of $1,440 in its allowance for doubtful accounts. The amount of credit sales for losses are estimated to be 9% of accounts receivable. a. What is (1) bad debt expense for the year and (2) the ending balance in the allowance for doubtful accounts? 1. Bad debt expense s 0 2. Allowance for doubtful accounts 5 0 b. How would the answer to part a change (if at all) if the company had a debit balance of $1,440 in its allowance 1. Bad debt expense 5 2. Allowance for doubtful accounts 5 0 0 Dit sales for the period is $192,000, and the balance in accounts receivable is $36,000. Assume that the expected credit al accounts? Its allowance for doubtful accounts before any adjustment

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts