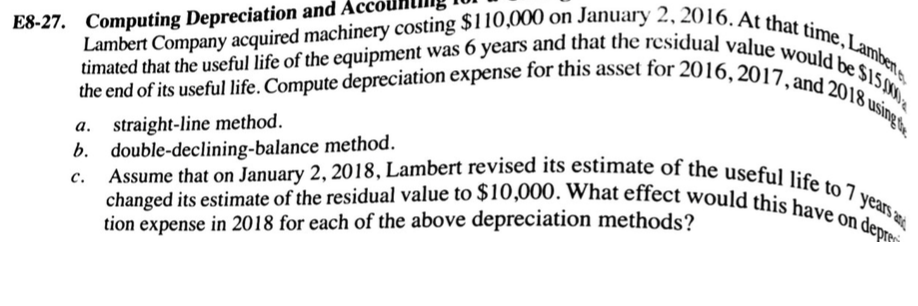

Question: Computing Depreciation and Accounting lot Lambert Com At that time. Lam timated that the useful life of the equipment was 6 years and that the

Computing Depreciation and Accounting lot Lambert Com At that time. Lam timated that the useful life of the equipment was 6 years and that the residualt time, the end of its useful life. Compute depreciation expense for this asset for 2016, 201z a. straight-line method. b. double-declining-balance method. c. Assume that on January 2, 2018, Lambert revised its estimate of the E8-27. idual value w Company acquired machinery costing $110.000 on January 2,20 ouldbe 6.2017,and 2018ust d its estimate of the useful life to 7 changed its estimate of the residual value to S10,000. What effect would this he 'o 7 yen tion expense in 2018 for each of the above depreciation methods? have on depre

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts