Question: Computing Depreciation, Asset Book Value, and Gain or Loss on Asset Sale (FSET) Sloan Company uses its own executive charter plane that originally cost $1,200,000.

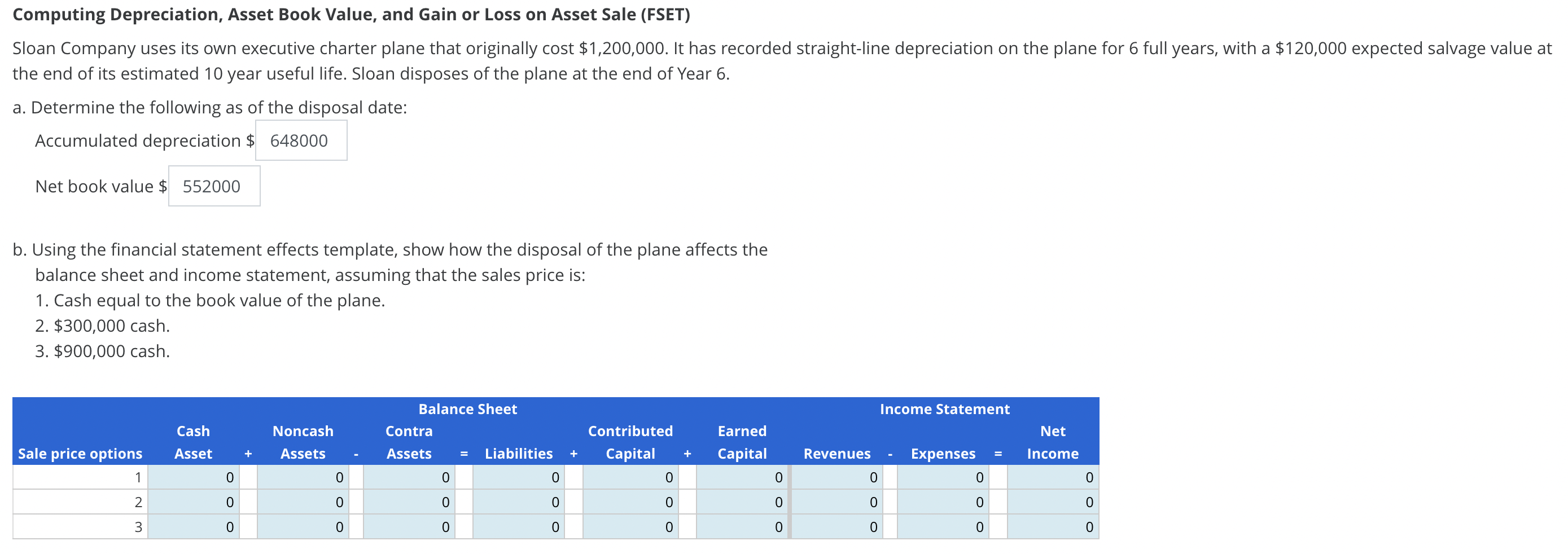

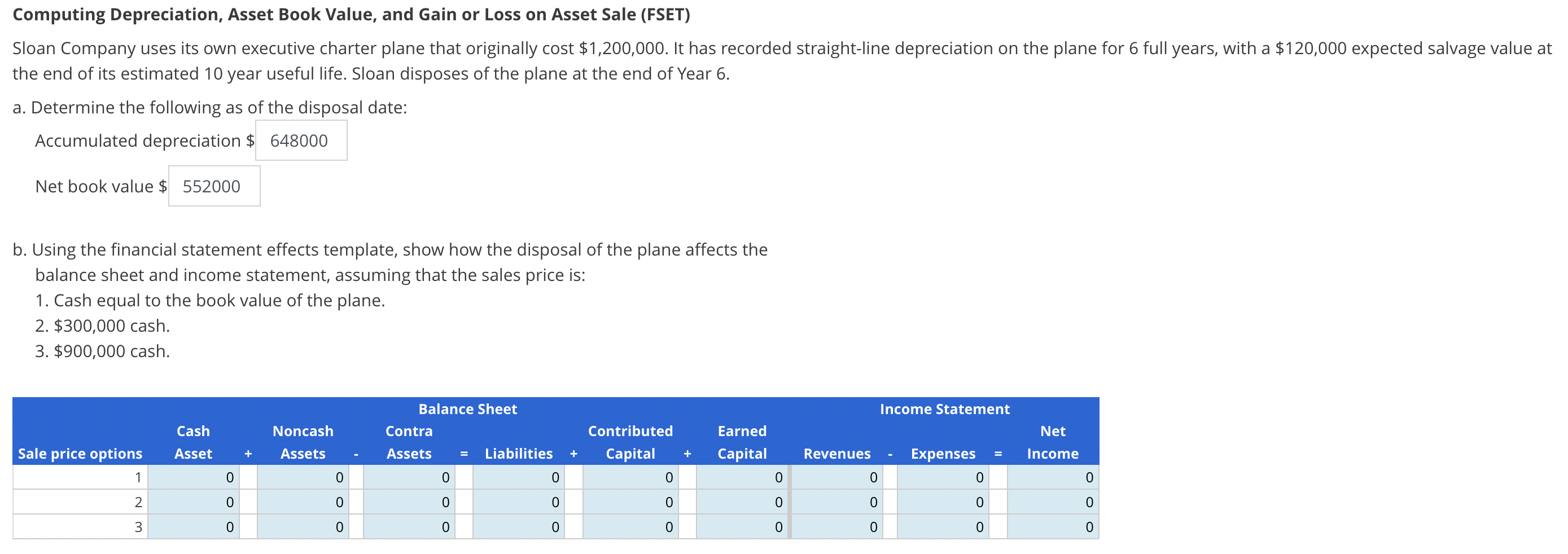

Computing Depreciation, Asset Book Value, and Gain or Loss on Asset Sale (FSET) Sloan Company uses its own executive charter plane that originally cost $1,200,000. It has recorded straight-line depreciation on the plane for 6 full years, with a $120,000 expected salvage value at the end of its estimated 10 year useful life Sloan disposes ofthe plane at the end onear 6. a. Determine the following as of the disposal date: Accumulated depreciation $ 648000 Net book value $ 552000 b, Using the financial statement effects template, show how the disposal of the plane affects the balance sheet and income statement, assuming that the sales price is: 1. Cash equal to the book value of the plane. 2. $300,000 cash. 3. $900,000 cash' Balance Sheet Income Statement Cash Noncash Contra Contributed Earned Salepriceoptions Asset + Assets - Assets = Liabilities + Capital + Capital Revenues - Expenses

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts