Question: Computing Depreciation, Net Book Value, and Gain or :pss pn Asset Sale On Janua purchases a laser cutting machine for use in fabrication of a

Computing Depreciation, Net Book Value, and Gain or :pss pn Asset Sale

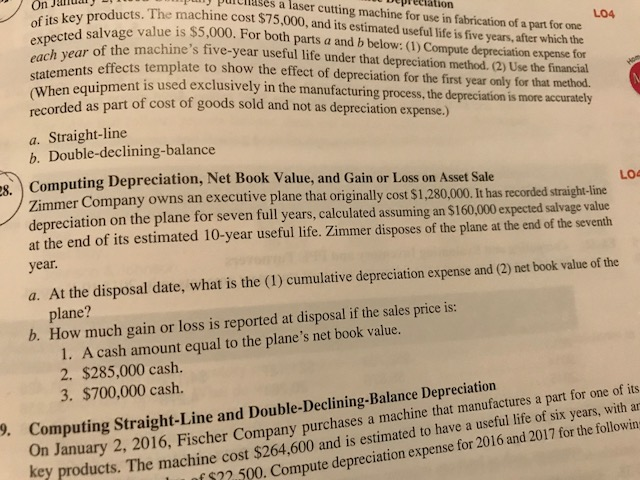

On Janua purchases a laser cutting machine for use in fabrication of a part for one epreciation machine cost $75,000, and its estimated useful life is five years, after which the rof the machine's five-year useful life under that depreciation method. (2) Use the financial ment is used exclusively in the manufacturing process, the depreciation is more accurately alue is $5,000. For both parts a and b below: (1) Compute depreciation 04 expense for ts effects template to show the effect of depreciation for the first year only for that method. recorded as part of cost of goods sold and not as depreciation expense.) a. Straight-line b. Double-declining-balance Computing Depreciation, Net Book Value, and Gain or Loss on Asset Sale LO er Company owns an executive plane that originally cost $1,280,000. It has recorded straight-line depreciation on the plane for seven full years, calculated assuming an $160,000 expected salvage value at the end of its estimated 10-year useful life. Zimmer disposes of the plane at the end of the seventh year a. At the disposal date, what is the (1) cumulative depreciation expense and (2) net book value of the plane? b. How much gain or loss is reported at disposal if the sales price is: 1. A cash amount equal to the plane's net book value. 2. $285,000 cash. 3. $700,000 cash. Computing Straight-Line and Double-Declining.Balance Depreciation On January 2, 2016, Fische key products. The machine cost $264,600 a r Company purchases a machine that manufactures a part for one o nd is estimated to have a useful life of six years, with f its 9. pense for 2016 and 2017 for the followin f $22.500. Compute depreciation ex

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts