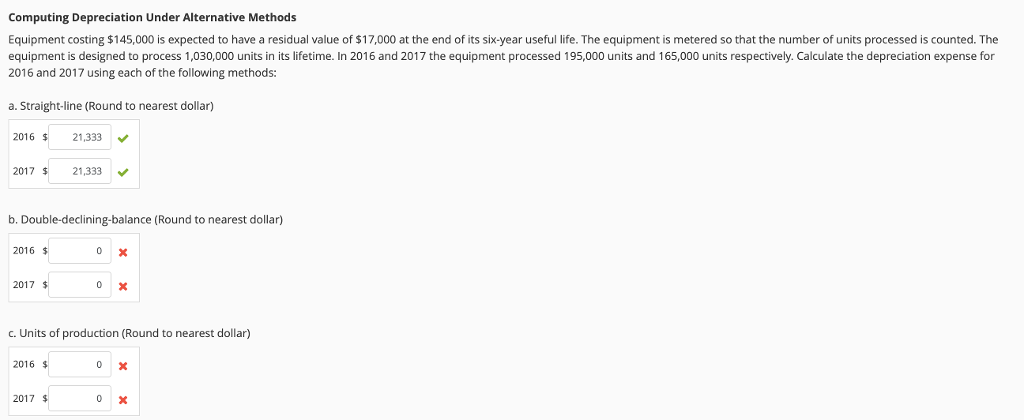

Question: Computing Depreciation Under Alternative Methods Equipment costing $145,000 is expected to have a residual value of $17,000 at the end of its six-year useful life.

Computing Depreciation Under Alternative Methods Equipment costing $145,000 is expected to have a residual value of $17,000 at the end of its six-year useful life. The equipment is metered so that the number of units processed is counted. The equipment is designed to process 1,030,000 units in its lifetime. In 2016 and 2017 the equipment processed 195,000 units and 165,000 units respectively. Calculate the depreciation expense for 2016 and 2017 using each of the following methods: a. Straight-line (Round to nearest dollar) 2016 21,333 2017 $21,333 b. Double-declining-balance (Round to nearest dollar) 2016 2017 c. Units of production (Round to nearest dollar) 2016 2017

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts