Question: Computing Depreciation Under Straight-Line and Double-Declining-Balance for Partial Years A machine costing $148,800 is purchased on May 1, 2016. The machine is expected to be

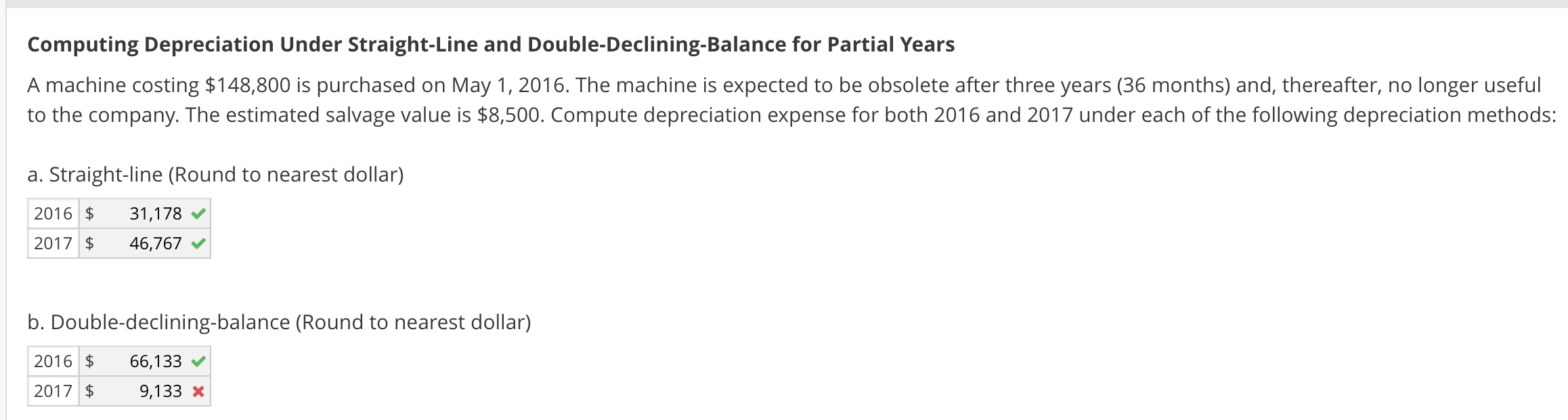

Computing Depreciation Under Straight-Line and Double-Declining-Balance for Partial Years A machine costing $148,800 is purchased on May 1, 2016. The machine is expected to be obsolete after three years (36 months) and, thereafter, no longer useful to the company. The estimated salvage value is $8,500. Compute depreciation expense for both 2016 and 2017 under each of the following depreciation methods: a. Straight-line (Round to nearest dollar) 2016 $ 31,178 46,767 2017 $ b. Double-declining-balance (Round to nearest dollar) 2016 $ 66,133 2017 $ 9,133 x

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts