Question: Computing discounting rates problem: Below is the summary report from your finance group regarding their analysis for determining discounting rates for the project at hand

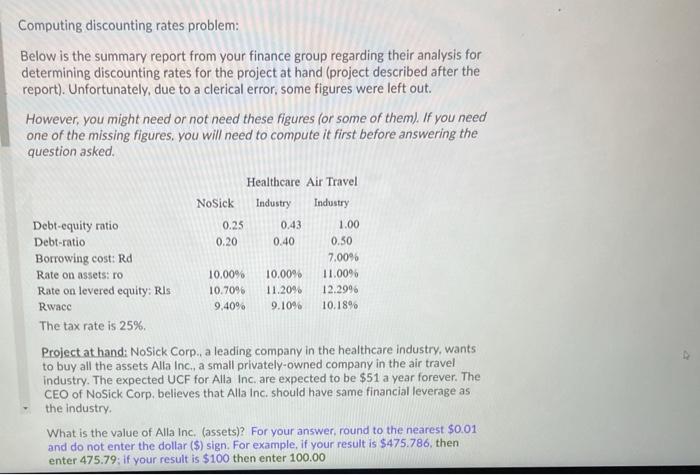

Computing discounting rates problem: Below is the summary report from your finance group regarding their analysis for determining discounting rates for the project at hand (project described after the report). Unfortunately, due to a clerical error, some figures were left out. However, you might need or not need these figures (or some of them). If you need one of the missing figures, you will need to compute it first before answering the question asked. Healthcare Air Travel NoSick Industry Industry Debt-equity ratio 0.25 0.43 1.00 Debt-ratio 0.20 0.40 0.50 Borrowing cost: Rd 7.00% Rate on assets: ro 10.00% 10.00% 11.00% Rate on levered equity: Ris 10.7096 11.20% 12.2996 Rwace 9,40% 9.1096 10.18% The tax rate is 25% Project at hand: NoSick Corp., a leading company in the healthcare industry, wants to buy all the assets Alla Inc, a small privately-owned company in the air travel industry. The expected UCF for Alla Inc. are expected to be $51 a year forever. The CEO of NoSick Corp, believes that Alla Inc. should have same financial leverage as the industry What is the value of Alla Inc. (assets)? For your answer, round to the nearest $0.01 and do not enter the dollar ($) sign. For example, if your result is $475.786, then enter 475.79; if your result is $100 then enter 100.00

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts