Question: Computing Dividends on Preferred Stock and Analyzing Differences The records of Hollywood Company reflected the following balances in the stockholders' equity accounts at the end

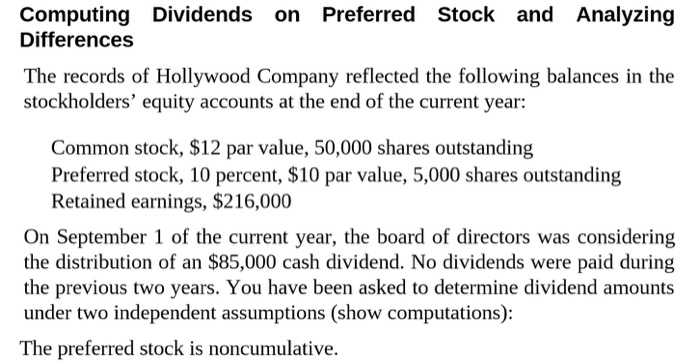

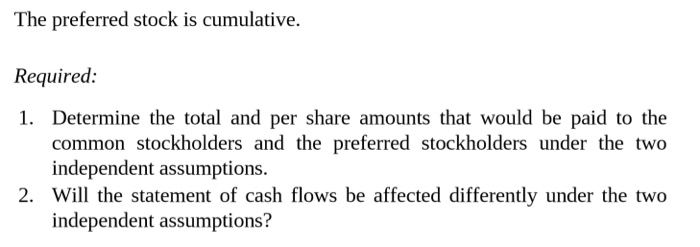

Computing Dividends on Preferred Stock and Analyzing Differences The records of Hollywood Company reflected the following balances in the stockholders' equity accounts at the end of the current year: Common stock, $12 par value, 50,000 shares outstanding Preferred stock, 10 percent, $10 par value, 5,000 shares outstanding Retained earnings, $216,000 On September 1 of the current year, the board of directors was considering the distribution of an $85,000 cash dividend. No dividends were paid during the previous two years. You have been asked to determine dividend amounts under two independent assumptions (show computations): The preferred stock is noncumulative. The preferred stock is cumulative. Required: 1. Determine the total and per share amounts that would be paid to the common stockholders and the preferred stockholders under the two independent assumptions. 2. Will the statement of cash flows be affected differently under the two independent assumptions

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts