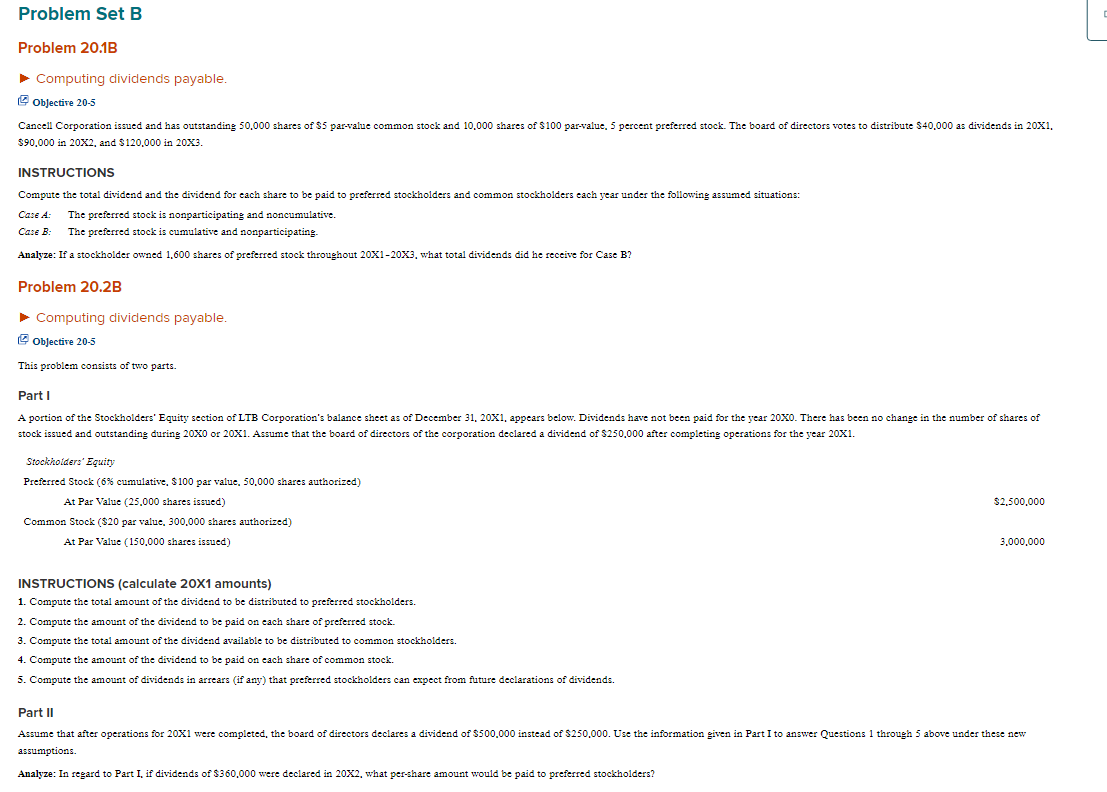

Question: Computing dividends payable. () Objective 20-5 $90,000 in 202, and $120,000 in 203. INSTRUCTIONS Compute the total dividend and the dividend for each share to

Computing dividends payable. () Objective 20-5 $90,000 in 202, and $120,000 in 203. INSTRUCTIONS Compute the total dividend and the dividend for each share to be paid to preferred stockholders and common stockholders each year under the following assumed situations: Case A. The preferred stock is nonparticipating and noncumulative. Case B: The preferred stock is cumulative and nonparticipating. Analyze: If a stockholder owned 1,600 shares of preferred stock throughout 201203, what total dividends did he receive for Case B? Problem 20.2B Computing dividends payable. Objective 20-5 This problem consists of two parts. Part I stock issued and outstanding during 20X0 or 20X1. Assume that the board of directors of the corporation declared a dividend of $250,000 after completing operations for the year 20X1. Stockhoiders' Equity Preferred Stock ( 6% cumulative, $100 par value, 50,000 shares authorized) At Par Value (25,000 shares issued ) $2,500,000 Common Stock (\$20 par value, 300,000 shares authorized) At Par Value (150,000 shares issued) 3,000,000 INSTRUCTIONS (calculate 201 amounts) 1. Compute the total amount of the dividend to be distributed to preferred stockholders. 2. Compute the amount of the dividend to be paid on each share of preferred stock. 3. Compute the total amount of the dividend available to be distributed to common stockholders. 4. Compute the amount of the dividend to be paid on each share of common stock. 5. Compute the amount of dividends in arrears (if any) that preferred stockholders can expect from future declarations of dividends. Part II assumptions. Analyze: In regard to Part I, if dividends of $360,000 were declared in 20X2, what per-share amount would be paid to preferred stockholders

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts