Question: Computing expected value in a business application Dit is a technology company that makes high end computer processors. Their newest processor, the lute is going

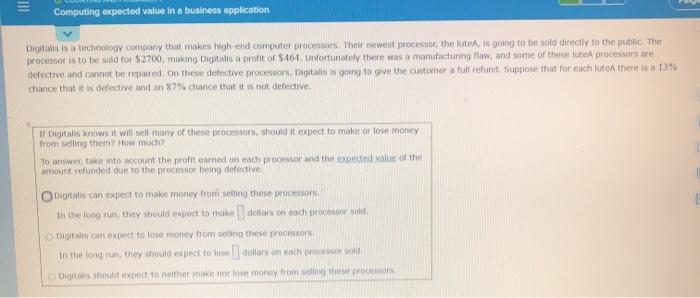

Computing expected value in a business application Dit is a technology company that makes high end computer processors. Their newest processor, the lute is going to be sold directly to the public. The processor is to be sold for $2700, making Digitalis a profit of $461. Unfortunately there was a manufacturing law, and some of these lute processors are defective and cannot be repared on these defective processors, Digitalis is going to give the customer a full refund. Suppose that for each lutea there is a 13% chance that it is defective and an 874 chance that it is not defective, If Digitale knows it will soll many of these processors, should it expect to make or lose money from selling them? How much? To answer take into account the protened on each procesor and the expected value of the amount refunded due to the processor being defective Digitalis can expect to make money from selling these processo in the long run, they should expect to make dollars on each processer old Digitalis can expect to lose money from selling these processors In the long run, they should expect to lose colors on each roosterwold Dis should expect to nether make or lose money from the pro

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts