Question: Computing Future Balance in Retirement Savings Acct ( Special Feature: Creating Time Value Formulas ) This exercise involves someone who plans to deposit regular annual

Computing Future Balance in Retirement Savings Acct Special Feature: Creating Time Value Formulas

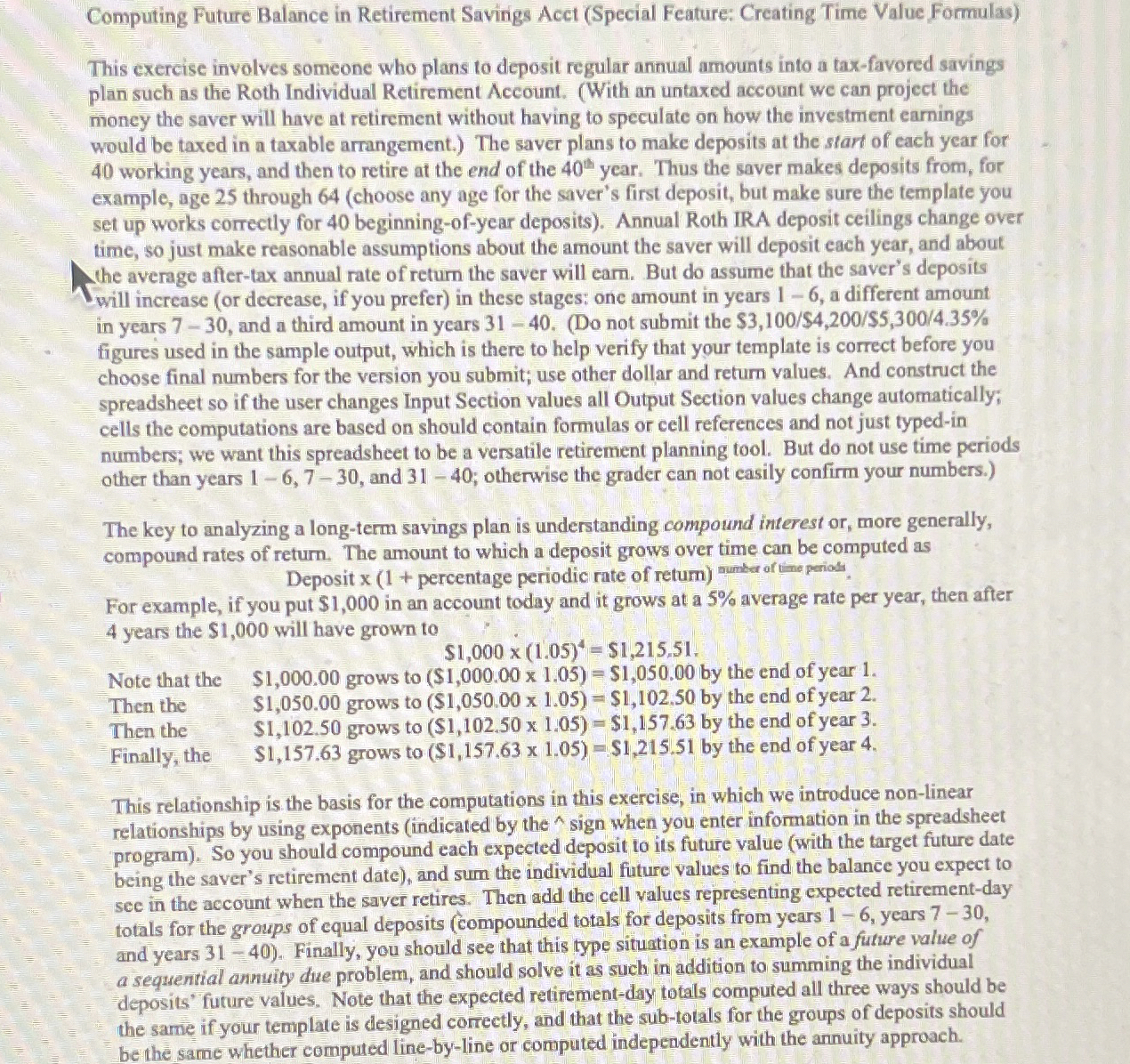

This exercise involves someone who plans to deposit regular annual amounts into a taxfavored savings

plan such as the Roth Individual Retirement Account. With an untaxed account we can project the

money the saver will have at retirement without having to speculate on how the investment earnings

would be taxed in a taxable arrangement. The saver plans to make deposits at the start of each year for

working years, and then to retire at the end of the year. Thus the saver makes deposits from, for

example, age through choose any age for the saver's first deposit, but make sure the template you

set up works correctly for beginningofyear deposits Annual Roth IRA deposit ceilings change over

time, so just make reasonable assumptions about the amount the saver will deposit each year, and about

the average aftertax annual rate of return the saver will carn. But do assume that the saver's deposits

in years and a third amount in years Do not submit the $

figures used in the sample output, which is there to help verify that your template is correct before you

choose final numbers for the version you submit; use other dollar and return values. And construct the

spreadsheet so if the user changes Input Section values all Output Section values change automatically;

cells the computations are based on should contain formulas or cell references and not just typedin

numbers; we want this spreadsheet to be a versatile retirement planning tool. But do not use time periods

other than years and ; otherwise the grader can not easily confirm your numbers.

The key to analyzing a longterm savings plan is understanding compound interest or more generally,

compound rates of return. The amount to which a deposit grows over time can be computed as

Deposit x percentage periodic rate of return sumber of ine perios.

For example, if you put $ in an account today and it grows at a average rate per year, then after

years the $ will have grown to

$$

Note that the $ grows to $$ by the end of year

Then the $ grows to $$ by the end of year

Then the $ grows to $$ by the end of year

Finally, the $ grows to $$ by the end of year

This relationship is the basis for the computations in this exercise, in which we introduce nonlinear

relationships by using exponents indicated by the sign when you enter information in the spreadsheet

program So you should compound each expected deposit to its future value with the target future date

being the saver's retirement date and sum the individual future values to find the balance you expect to

see in the account when the saver retires. Then add the cell values representing expected retirementday

totals for the groups of equal deposits compounded totals for deposits from years years

and years Finally, you should see that this type situation is an example of a future value of

a sequential annuity due problem, and should solve it as such in addition to summing the individual

"deposits' future values. Note that the expected retirementday totals computed all three ways should be

the same if your template is designed correctly, and that the subtotals for the groups of deposits should

be the same whether computed linebyline or computed independently with the annuity approach.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock