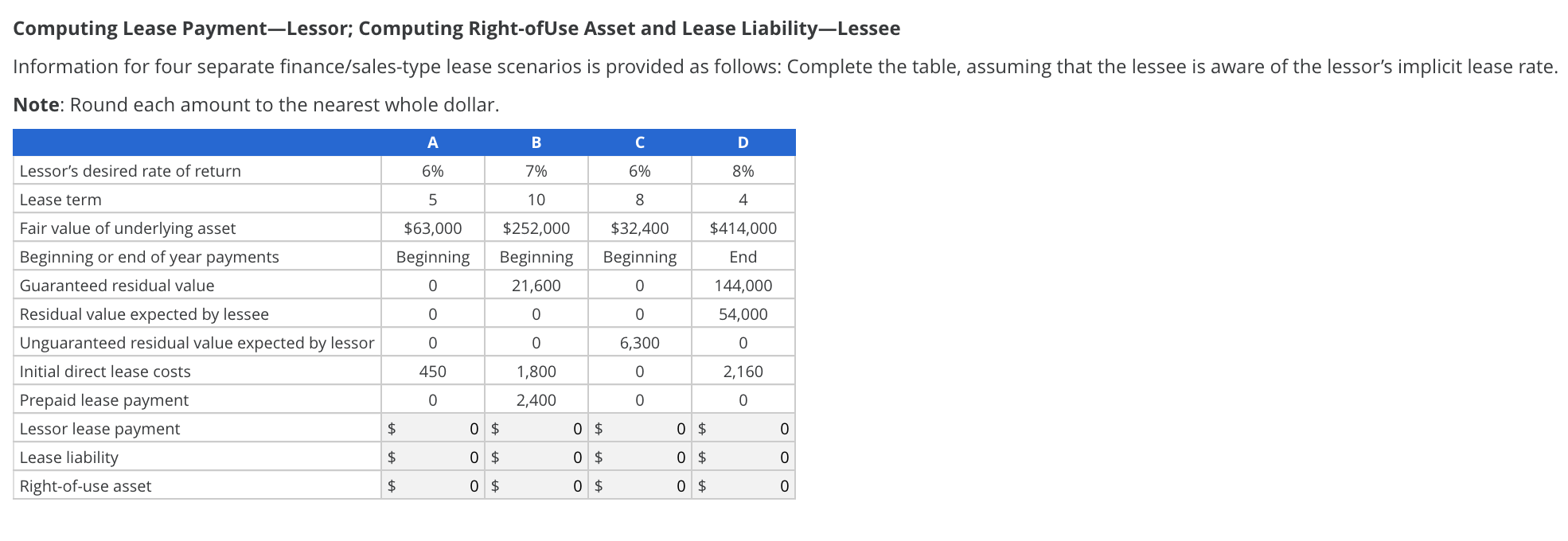

Question: Computing Lease Payment-Lessor; Computing Right-ofUse Asset and Lease Liability-Lessee Information for four separate finance/sales-type lease scenarios is provided as follows: Complete the table, assuming that

Computing Lease Payment-Lessor; Computing Right-ofUse Asset and Lease Liability-Lessee Information for four separate finance/sales-type lease scenarios is provided as follows: Complete the table, assuming that the lessee is aware of the lessor's implicit lease rate. Note: Round each amount to the nearest whole dollar. A B D Lessor's desired rate of return 6% 7% 6% 8% 5 10 8 4 $63,000 Beginning $252,000 Beginning 21,600 $32,400 Beginning $414,000 End 0 O o 144,000 54,000 0 0 Lease term Fair value of underlying asset Beginning or end of year payments Guaranteed residual value Residual value expected by lessee Unguaranteed residual value expected by lessor Initial direct lease costs Prepaid lease payment Lessor lease payment Lease liability Right-of-use asset 0 0 6,300 0 450 0 2,160 1,800 2,400 0 0 0 0 $ 0 $ 0 $ $ $ 0 $ 0 $ 0 $ O O O $ 0 $ 0 $ 0 $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts