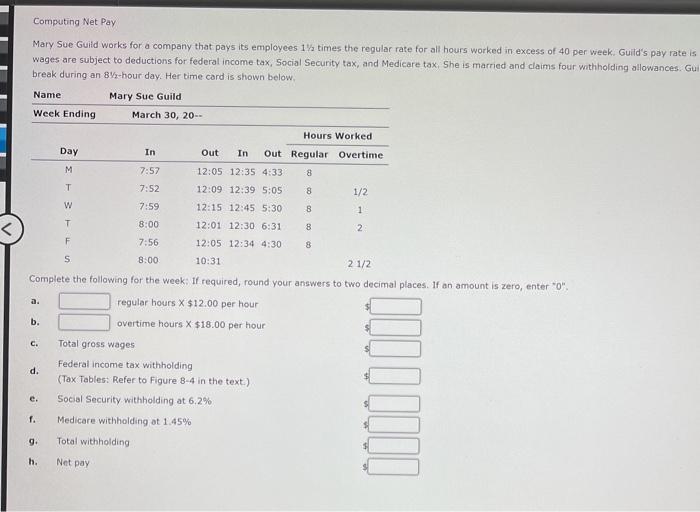

Question: Computing Net Pay Day Mary Sue Guild works for a company that pays its employees 1 times the regular rate for all hours worked in

Computing Net Pay Day Mary Sue Guild works for a company that pays its employees 1 times the regular rate for all hours worked in excess of 40 per week. Guild's pay rate is wages are subject to deductions for federal income tax, Social Security tax, and Medicare tax She is married and claims four withholding allowances. Gul break during an 8-hour day. Her time card is shown below Name Mary Sue Guild Week Ending March 30, 20- Hours Worked In Out In Out Regular Overtime M 7:57 12:05 12:35 4:33 7:52 12:09 12:39 5:05 8 1/2 w 7:59 12:15 12:45 5:30 1 T T 8:00 12:01 12:30 6:31 8 2 F 7:56 12:05 12:34 4:30 8 S 8:00 10:31 2 1/2 Complete the following for the week: If required, round your answers to two decimal places. If an amount is zero, enter "0" regular hours X $12.00 per hour b. overtime hours X $18.00 per hour C. d. Total gross wages Federal income tax withholding (Tax Tables: Refer to Figure 8-4 in the text) Social Security withholding at 6.2% Medicare withholding at 1.45% Total withholding e. 1. 9. h. Net pay

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts