Question: Computing Net Pay Mary Sue Guild works for a company that pays its employees 1 1 2 times the regular rate for all hours worked

Computing Net Pay

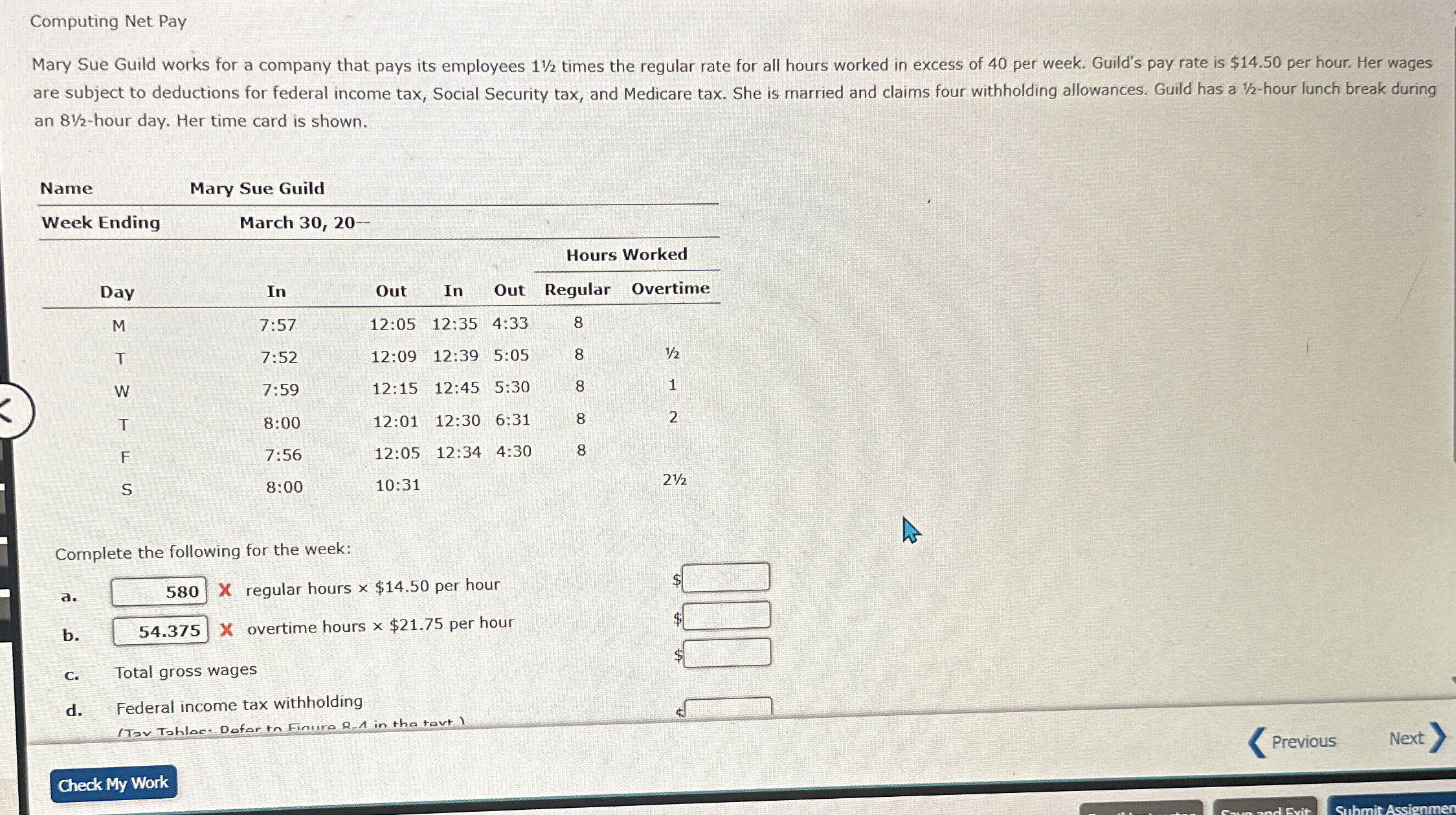

Mary Sue Guild works for a company that pays its employees times the regular rate for all hours worked in excess of per week. Guild's pay rate is $ per hour. Her wages are subject to deductions for federal income tax, Social Security tax, and Medicare tax. She is married and claims four withholding allowances. Guild has a hour lunch break during an hour day. Her time card is shown.

Complete the following for the week:

a regular hours $ per hour

b overtime hours $ per hour

C Total gross wages

$ $

$

$

d Federal income tax withholding

Previous

Next

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock