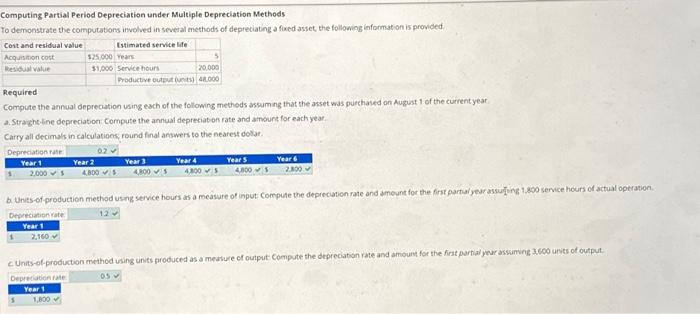

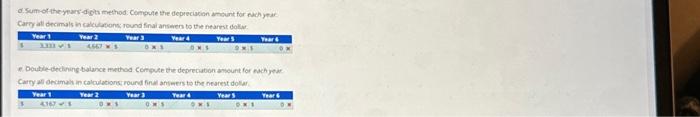

Question: Computing Partial Period Depreciation under Multiple Depreciation Methods To demonstrate the computations involved in several methods of depreciating a focd asset, the following information is

Computing Partial Period Depreciation under Multiple Depreciation Methods To demonstrate the computations involved in several methods of depreciating a focd asset, the following information is provided. Required Compute the annual depreciation using each of the following methods assuming that the asset was purchased on Auguast 1 of the current year. a. Stragheline depreciation Compute the annual depretiat on rate and ainouns for each year. Carry all decimals in calculations, round final answers to the nearest dotar. Desureciation rate Computing Partial Period Depreciation under Multiple Depreciation Methods To demonstrate the computations involved in several methods of depreciating a focd asset, the following information is provided. Required Compute the annual depreciation using each of the following methods assuming that the asset was purchased on Auguast 1 of the current year. a. Stragheline depreciation Compute the annual depretiat on rate and ainouns for each year. Carry all decimals in calculations, round final answers to the nearest dotar. Desureciation rate

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts