Question: Computing Partial Period Depreciation Using Various Depreciation Methods Quick Producers acquired factory equipment on March 1 of Year 1 costing $ 7 8 , 0

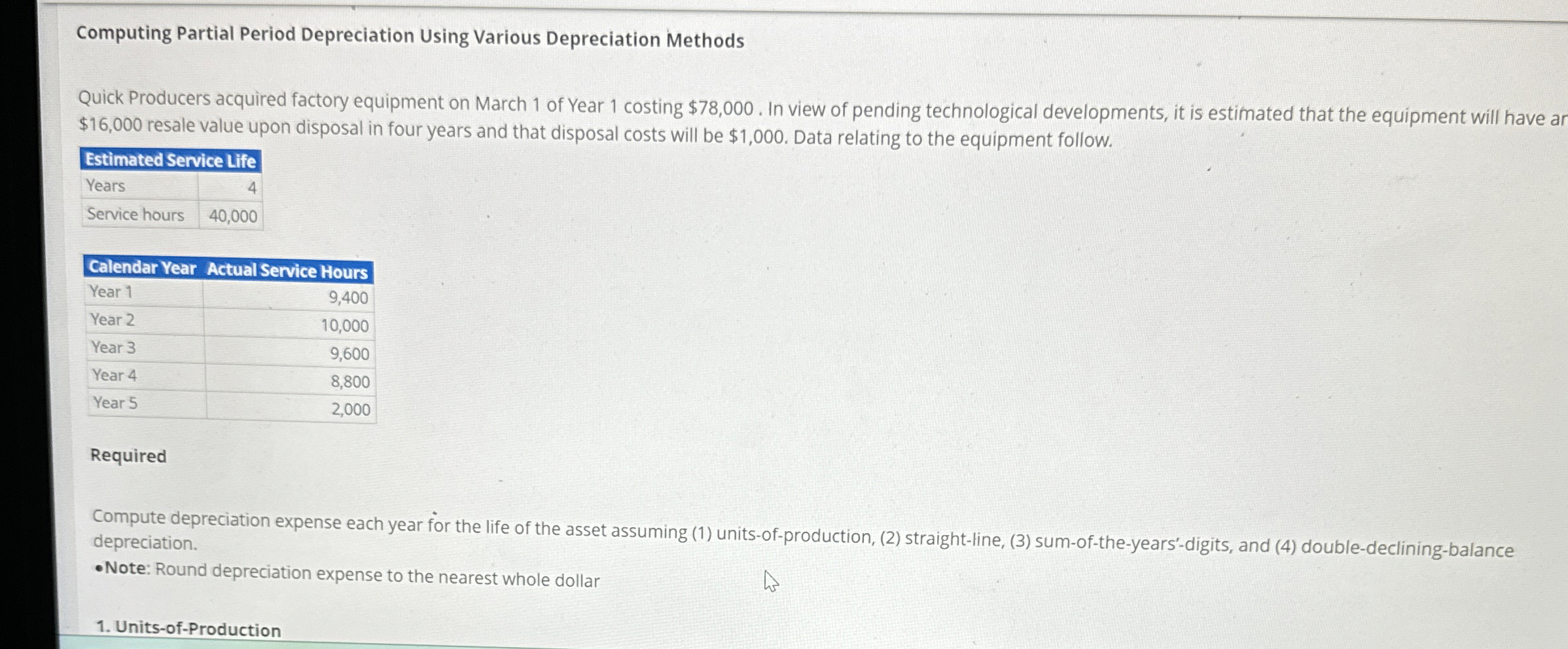

Computing Partial Period Depreciation Using Various Depreciation Methods

Quick Producers acquired factory equipment on March of Year costing $ In view of pending technological developments, it is estimated that the equipment will have ar $ resale value upon disposal in four years and that disposal costs will be $ Data relating to the equipment follow.

tableEstimated Service LifeYearsService hours,

Calendar Year Actual Service Hours

tableYear Year Year Year Year

Required

Compute depreciation expense each year for the life of the asset assuming unitsofproduction, straightline, sumoftheyears'digits, and doubledecliningbalance depreciation.

Note: Round depreciation expense to the nearest whole dollar

UnitsofProduction

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock