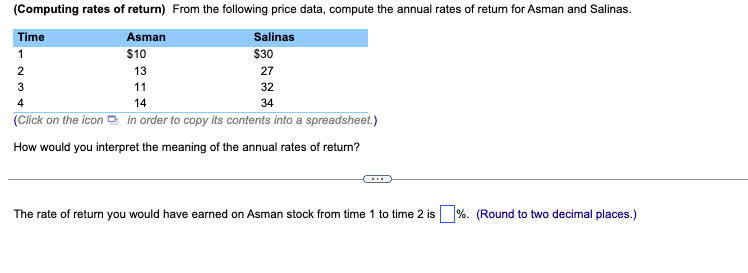

Question: (Computing rates of return) From the following price data, compute the annual rates of return for Asman and Salinas. Asman Salinas $10 $30 Time 1

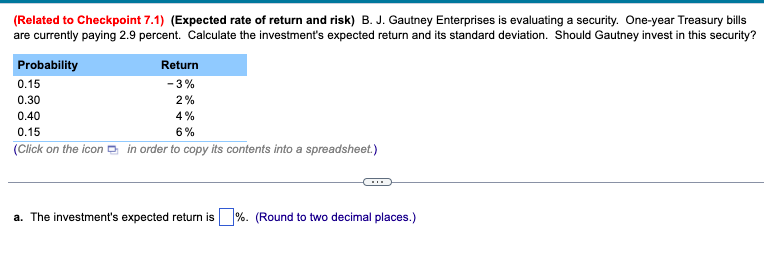

(Computing rates of return) From the following price data, compute the annual rates of return for Asman and Salinas. Asman Salinas $10 $30 Time 1 2 3 4 13 11 14 27 32 34 (Click on the icon in order to copy its contents into a spreadsheet.) How would you interpret the meaning of the annual rates of return? The rate of return you would have earned on Asman stock from time 1 to time 2 is %. (Round to two decimal places.) (Related to Checkpoint 7.1) (Expected rate of return and risk) B. J. Gautney Enterprises is evaluating a security. One-year Treasury bills are currently paying 2.9 percent. Calculate the investment's expected return and its standard deviation. Should Gautney invest in this security? Probability Return 0.15 -3% 0.30 4% 0.15 6% (Click on the icon in order to copy its contents into a spreadsheet.) 2% 0.40 a. The investment's expected return is %. (Round to two decimal places.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts