Question: (Computing rates of return) From the following price data, compute the annual rates of return for Asman and Salinas. Time 1 2 3 4 Asman

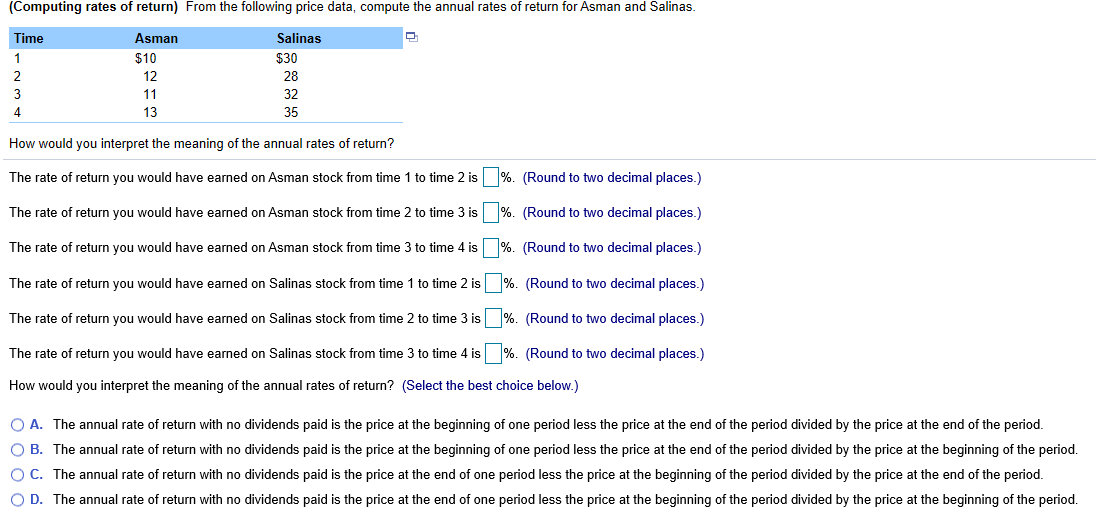

(Computing rates of return) From the following price data, compute the annual rates of return for Asman and Salinas. Time 1 2 3 4 Asman $10 12 11 13 Salinas $30 28 32 35 How would you interpret the meaning of the annual rates of return? The rate of return you would have earned on Asman stock from time 1 to time 2 is %. (Round to two decimal places.) The rate of return you would have earned on Asman stock from time 2 to time 3 is %. (Round to two decimal places.) The rate of return you would have earned on Asman stock from time 3 to time 4 is %. (Round to two decimal places.) The rate of return you would have earned on Salinas stock from time 1 to time 2 is %. (Round to two decimal places.) The rate of return you would have earned on Salinas stock from time 2 to time 3 is %. (Round to two decimal places.) The rate of return you would have earned on Salinas stock from time 3 to time 4 is %. (Round to two decimal places.) How would you interpret the meaning of the annual rates of return? (Select the best choice below.) A. The annual rate of return with no dividends paid is the price at the beginning of one period less the price at the end of the period divided by the price at the end of the period. B. The annual rate of return with no dividends paid is the price at the beginning of one period less the price at the end of the period divided by the price at the beginning of the period. OC. The annual rate of return with no dividends paid is the price at the end of one period less the price at the beginning of the period divided by the price at the end of the period. OD. The annual rate of return with no dividends paid is the price at the end of one period less the price at the beginning of the period divided by the price at the beginning of the period

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts