Question: (Computing ratios) Use the information from the balance sheet and income statement in the popup window, to calculate the following ratios: a. Current ratio b.

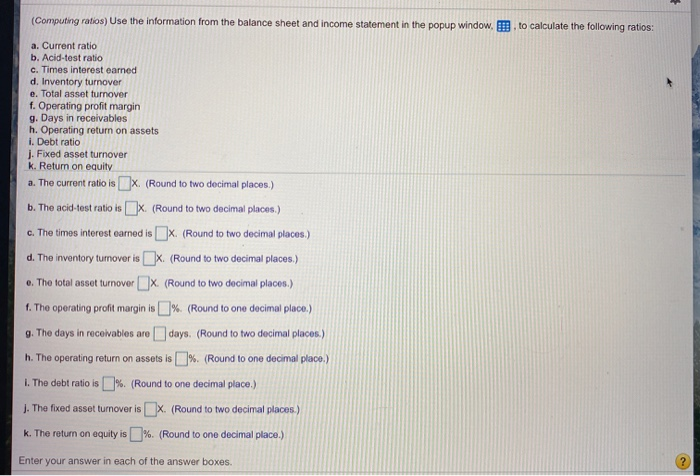

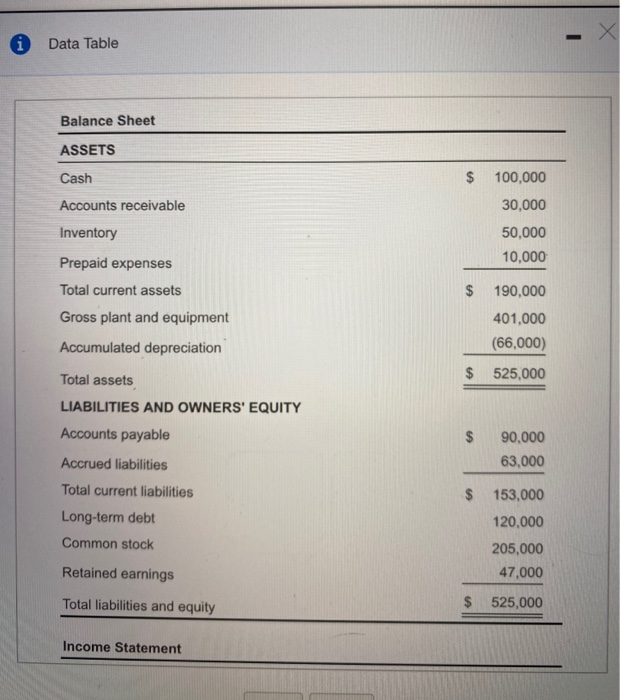

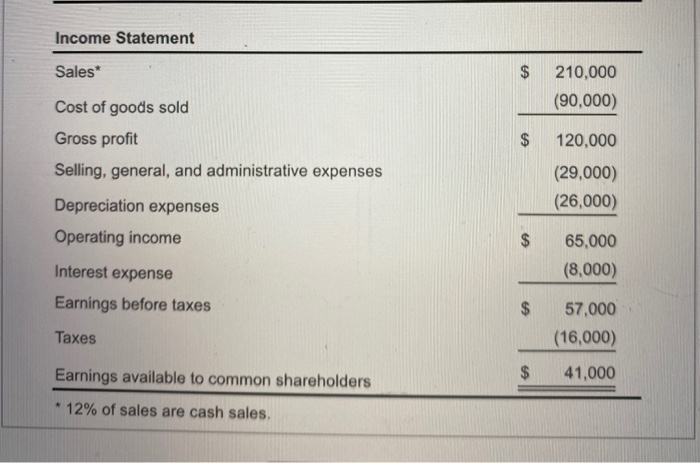

(Computing ratios) Use the information from the balance sheet and income statement in the popup window, to calculate the following ratios: a. Current ratio b. Acid-test ratio c. Times interest earned d. Inventory turnover e. Total asset turnover f. Operating profit margin g. Days in receivables h. Operating return on assets i. Debt ratio j. Fixed asset turnover k. Return on equity a. The current ratio is X. (Round to two decimal places.) b. The acid-test ratio is X. (Round to two decimal places.) c. The times interest earned is X. (Round to two decimal places.) d. The inventory turnover is x (Round to two decimal places.) e. The total asset turnover X (Round to two decimal places.) 1. The operating profit margin is % (Round to one decimal place.) 9. The days in receivables are days. (Round to two decimal places.) h. The operating return on assets is %. (Round to one decimal place.) 1. The debt ratio is %. (Round to one decimal place.) J. The fixed asset turnover is X. (Round to two decimal places.) k. The return on equity is %. (Round to one decimal place.) Enter your answer in each of the answer boxes 1 Data Table Balance Sheet ASSETS Cash $ 100,000 30,000 50,000 10,000 Accounts receivable Inventory Prepaid expenses Total current assets Gross plant and equipment Accumulated depreciation 190,000 401,000 (66,000) 525.000 $ Total assets LIABILITIES AND OWNERS' EQUITY Accounts payable 90,000 63,000 $ Accrued liabilities Total current liabilities Long-term debt Common stock 153,000 120,000 205,000 47,000 Retained earnings Total liabilities and equity 525,000 Income Statement Income Statement Sales* $ 210,000 (90,000) Cost of goods sold Gross profit Selling, general, and administrative expenses 120,000 (29,000) (26,000) Depreciation expenses Operating income $ 65,000 (8,000) Interest expense Earnings before taxes $ Taxes 57,000 (16,000) 41,000 Earnings available to common shareholders * 12% of sales are cash sales

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts