Question: Computing Return on Equity and Return on Assets The following table contains financial statement information for Walmart Inc. $ millions Total Assets Net Income Sales

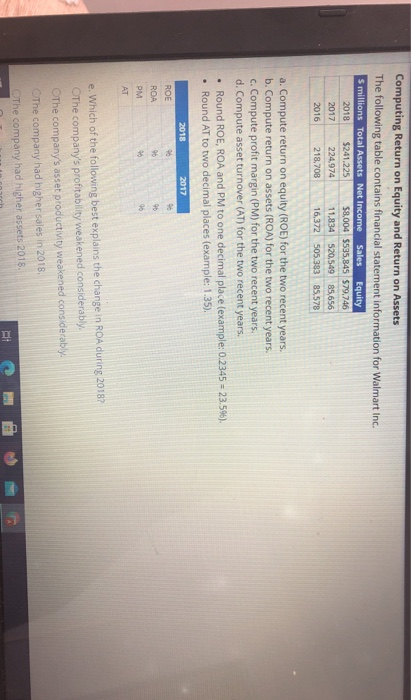

Computing Return on Equity and Return on Assets The following table contains financial statement information for Walmart Inc. $ millions Total Assets Net Income Sales Equity 2018 $241.225 58,004 $535,845 579,746 2017 224,974 11.834 520,549 85,656 2016 218,708 16,372 505.383 85.578 a. Compute return on equity (ROE) for the two recent years. b. Compute return on assets (ROA) for the two recent years. c. Compute profit margin (PM) for the two recent years. d. Compute asset turnover (AT) for the two recent years. Round ROE, ROA and PM to one decimal place (example: 0.2345 = 23.596), Round AT to two decimal places (example: 1.35) . 2018 2017 96 ROE ROA 16 PM 96 e. Which of the following best explains the change in ROA during 2018? The company's profitability weakened considerably The company's asset productivity weakened considerably. The company had higher sales in 2018 The company had higher assets 2018

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts