Question: Computing the Acquisition Cost and Recording Depreciation under Three Alternative Methods (AP8-3) At the beginning of the year, Plummer's Sports Center bought three used fitness

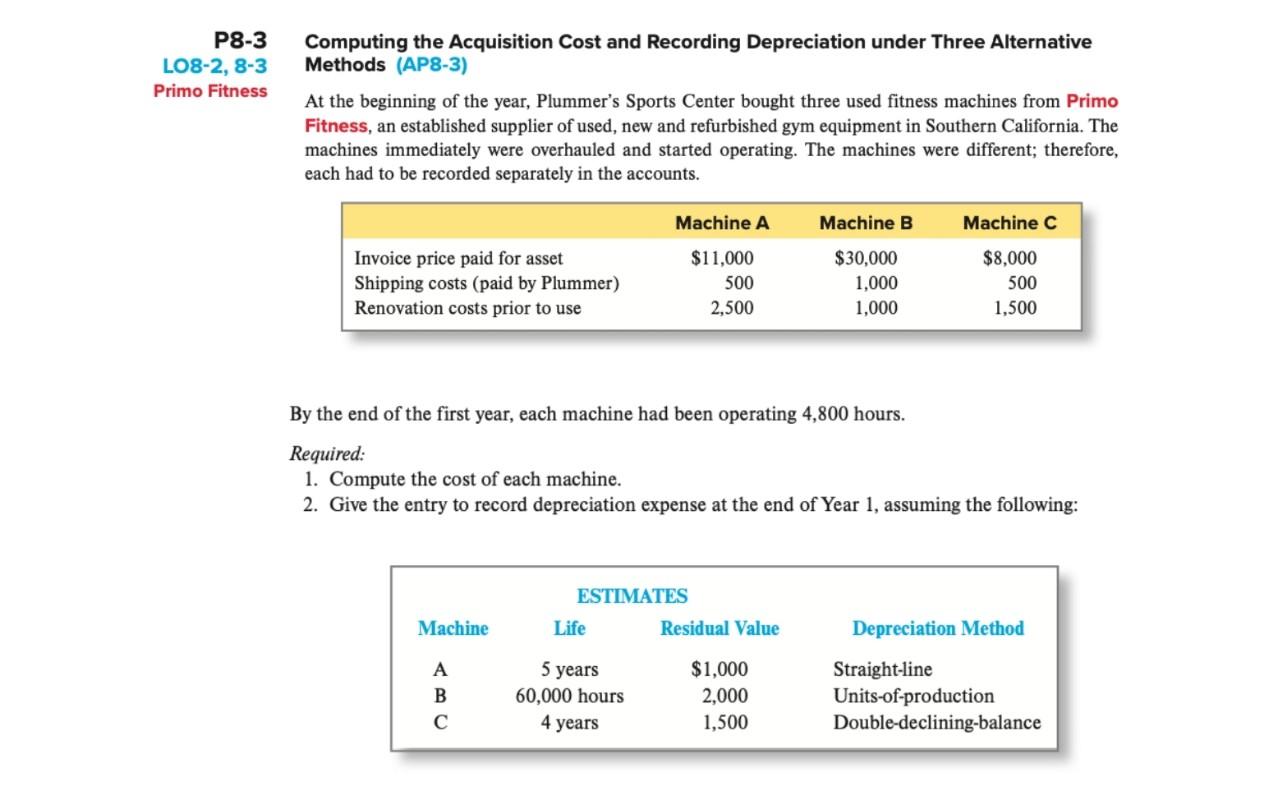

Computing the Acquisition Cost and Recording Depreciation under Three Alternative Methods (AP8-3) At the beginning of the year, Plummer's Sports Center bought three used fitness machines from Primo Fitness, an established supplier of used, new and refurbished gym equipment in Southern California. The machines immediately were overhauled and started operating. The machines were different; therefore, each had to be recorded separately in the accounts. By the end of the first year, each machine had been operating 4,800 hours. Required: 1. Compute the cost of each machine. 2. Give the entry to record depreciation expense at the end of Year 1, assuming the following: Computing the Acquisition Cost and Recording Depreciation under Three Alternative Methods (AP8-3) At the beginning of the year, Plummer's Sports Center bought three used fitness machines from Primo Fitness, an established supplier of used, new and refurbished gym equipment in Southern California. The machines immediately were overhauled and started operating. The machines were different; therefore, each had to be recorded separately in the accounts. By the end of the first year, each machine had been operating 4,800 hours. Required: 1. Compute the cost of each machine. 2. Give the entry to record depreciation expense at the end of Year 1, assuming the following

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts