Question: Computing the present value of a future cash flow to determine what that cash flow is worth today is called: Multiple Choice compounding. factoring. time

Computing the present value of a future cash flow to determine what that cash flow is worth today is called:

Multiple Choice

compounding.

factoring.

time valuation.

simple cash flow valuation.

discounted cash flow valuation.

Jessica invested $ today in an investment that pays percent annual interest. Which one of the following statements is correct, assuming all

interest is reinvested?

Multiple Choice

She will earn the same amount of interest each year.

She could have the same future value and invest less than $ initially if she could earn more than percent interest.

She will earn an increasing amount of interest each year even if she should decide to withdraw the interest annually rather than reinvesting

the interest.

Her interest for Year will be equal to $

She will be earning simple interest.

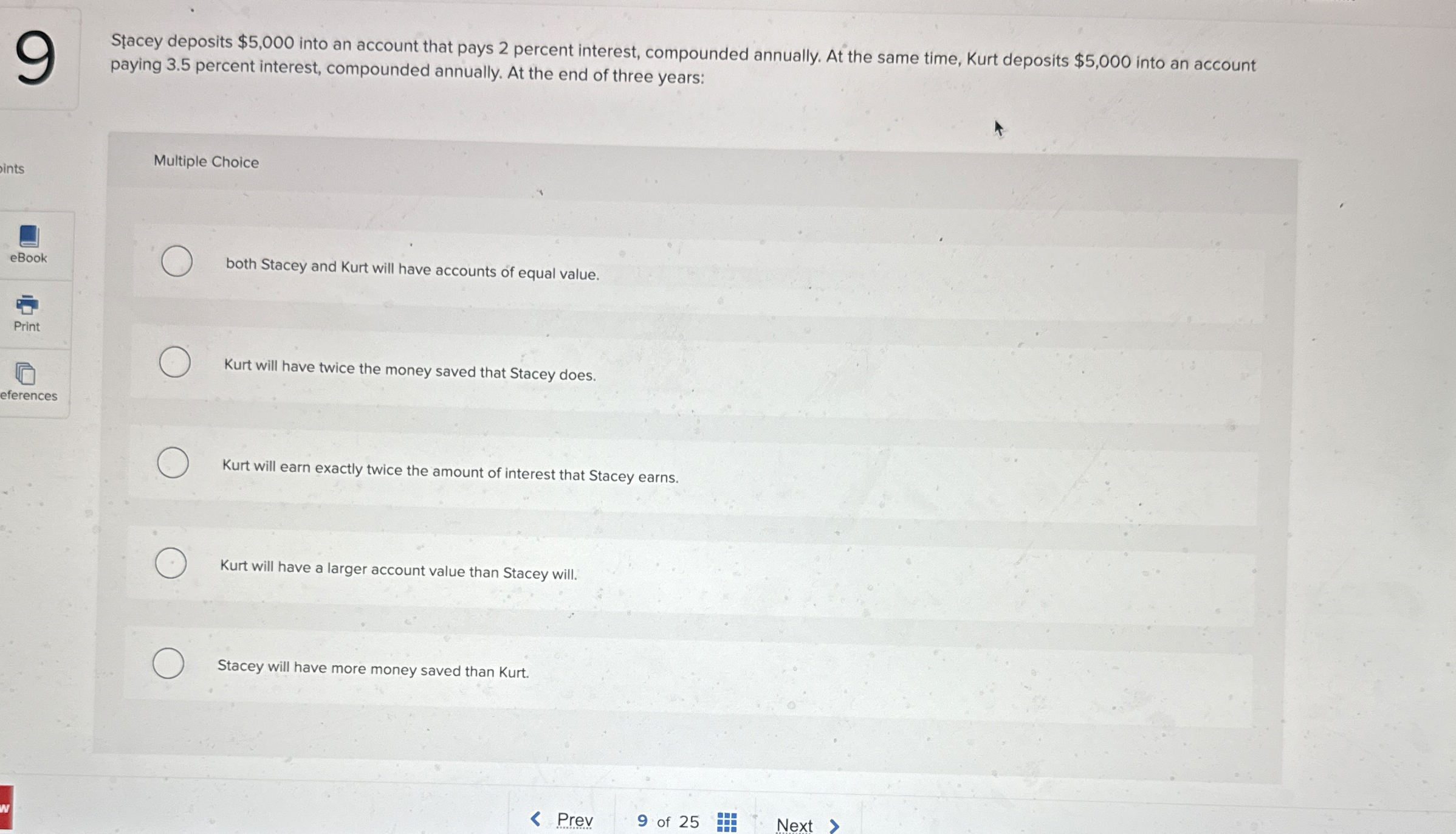

Sacey deposits $ into an account that pays percent interest, compounded annually. At the same time, Kurt deposits $ into an account

paying percent interest, compounded annually. At the end of three years:

Multiple Choice

both Stacey and Kurt will have accounts of equal value.

Kurt will have twice the money saved that Stacey does.

Kurt will earn exactly twice the amount of interest that Stacey earns.

Kurt will have a larger account value than Stacey will.

Stacey will have more money saved than Kurt.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock