Question: Computing Variance, Covariance, and Correlation Coefficients (Pg 203 of Text) 1. Collect daily price data for the past 30 trading days and compute the daily

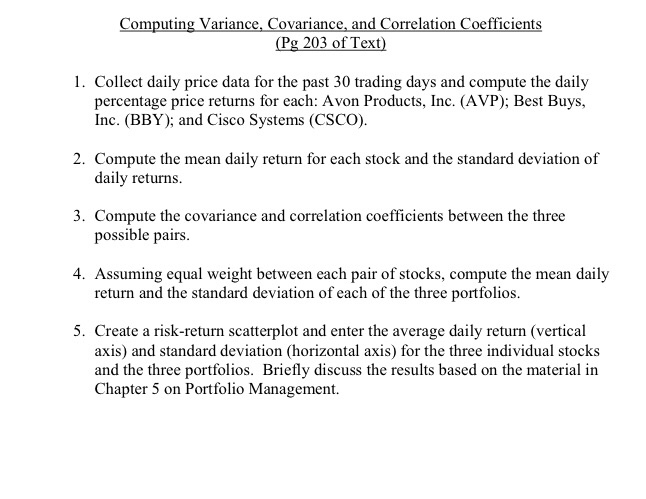

Computing Variance, Covariance, and Correlation Coefficients (Pg 203 of Text) 1. Collect daily price data for the past 30 trading days and compute the daily percentage price returns for each: Avon Products, Inc. (AVP); Best Buys, Inc. (BBY); and Cisco Systems (CSCo) 2. Compute the mean daily return for each stock and the standard deviation of daily returns. 3. Compute the covariance and correlation coefficients between the three possible pairs. 4. Assuming equal weight between each pair of stocks, compute the mean daily return and the standard deviation of each of the three portfolios. 5. Create a risk-return scatterplot and enter the average daily return (vertical axis) and standard deviation (horizontal axis) for the three individual stocks and the three portfolios. Briefly discuss the results based on the material in Chapter 5 on Portfolio Management. Computing Variance, Covariance, and Correlation Coefficients (Pg 203 of Text) 1. Collect daily price data for the past 30 trading days and compute the daily percentage price returns for each: Avon Products, Inc. (AVP); Best Buys, Inc. (BBY); and Cisco Systems (CSCo) 2. Compute the mean daily return for each stock and the standard deviation of daily returns. 3. Compute the covariance and correlation coefficients between the three possible pairs. 4. Assuming equal weight between each pair of stocks, compute the mean daily return and the standard deviation of each of the three portfolios. 5. Create a risk-return scatterplot and enter the average daily return (vertical axis) and standard deviation (horizontal axis) for the three individual stocks and the three portfolios. Briefly discuss the results based on the material in Chapter 5 on Portfolio Management

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts