Question: con completion Status 3 11 12 13 16 17 18 19 - A Moving to another question will save this response Question 10 of 1

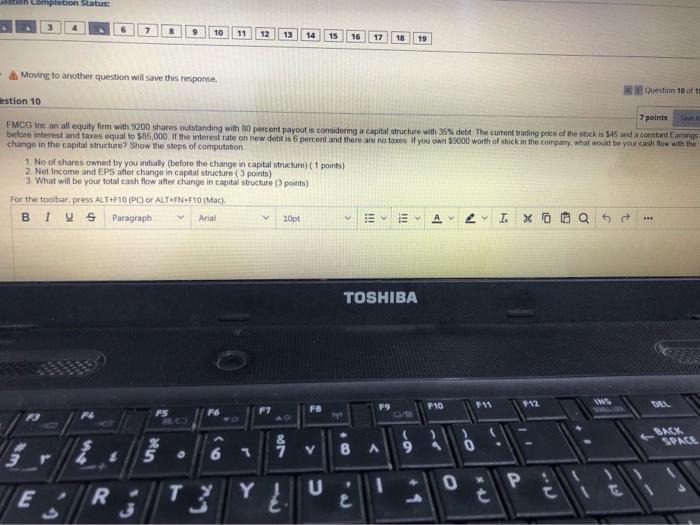

con completion Status 3 11 12 13 16 17 18 19 - A Moving to another question will save this response Question 10 of 1 estion 10 7 points FMCG in an all equity firm with 9200 shares outstanding with 80 percent payout is considering a capital structure with 35% debe The current trading price of the stock $15 and a constant Ears before interest and taces equal to $85,000 If the interest rate on new debtis 6 percent and there are now you own 89000 worth of stock in the company what would be your cash flow with the change in the capital structure Show the steps of computation 1. No of shares owned by you initially (before the change in capital structure) (1 points) 2 Net Income and EPS after change in capital structure ( 3 points) 3. What will be your total cash flow after change in capital structure (3 points) For the toolbar, press ALT+F10 (PC) or ALT EN F10 (Mac) BTU $ Paragraph Arial 10pt I. YO TOSHIBA FB F10 WS 741 12 ST ONS SPASE & 7 6 1 V 9 8 A U Y 0 R E 3 & * t i

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts