Question: Conceptual Assignment 2: Valuation techniques Refrain from using definitions to answer your question and do not write your answers verbatim from any external sources. Use

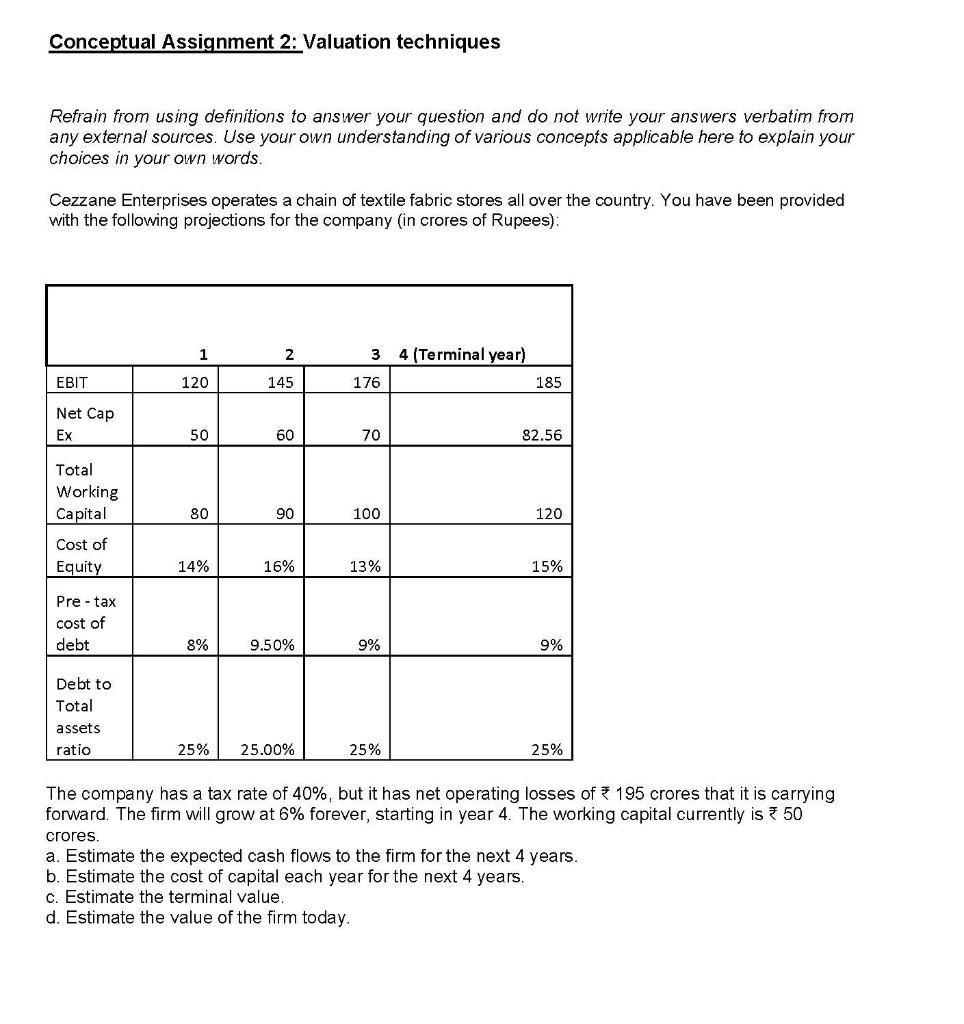

Conceptual Assignment 2: Valuation techniques Refrain from using definitions to answer your question and do not write your answers verbatim from any external sources. Use your own understanding of various concepts applicable here to explain your choices in your own words. Cezzane Enterprises operates a chain of textile fabric stores all over the country. You have been provided with the following projections for the company (in crores of Rupees): 1 2 3 4 (Terminal year) EBIT 120 145 176 Net Cap Ex 50 60 70 Total Working Capital 80 90 100 Cost of Equity 14% 16% 13% Pre-tax cost of debt 8% 9.50% 9% 9% Debt to Total assets. ratio 25% 25.00% 25% 25% The company has a tax rate of 40%, but it has net operating losses of 195 crores that it is carrying forward. The firm will grow at 6% forever, starting in year 4. The working capital currently is * 50 crores. a. Estimate the expected cash flows to the firm for the next 4 years. b. Estimate the cost of capital each year for the next 4 years. c. Estimate the terminal value. d. Estimate the value of the firm today. 185 82.56 120 15% Conceptual Assignment 2: Valuation techniques Refrain from using definitions to answer your question and do not write your answers verbatim from any external sources. Use your own understanding of various concepts applicable here to explain your choices in your own words. Cezzane Enterprises operates a chain of textile fabric stores all over the country. You have been provided with the following projections for the company (in crores of Rupees): 1 2 3 4 (Terminal year) EBIT 120 145 176 Net Cap Ex 50 60 70 Total Working Capital 80 90 100 Cost of Equity 14% 16% 13% Pre-tax cost of debt 8% 9.50% 9% 9% Debt to Total assets. ratio 25% 25.00% 25% 25% The company has a tax rate of 40%, but it has net operating losses of 195 crores that it is carrying forward. The firm will grow at 6% forever, starting in year 4. The working capital currently is * 50 crores. a. Estimate the expected cash flows to the firm for the next 4 years. b. Estimate the cost of capital each year for the next 4 years. c. Estimate the terminal value. d. Estimate the value of the firm today. 185 82.56 120 15%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts