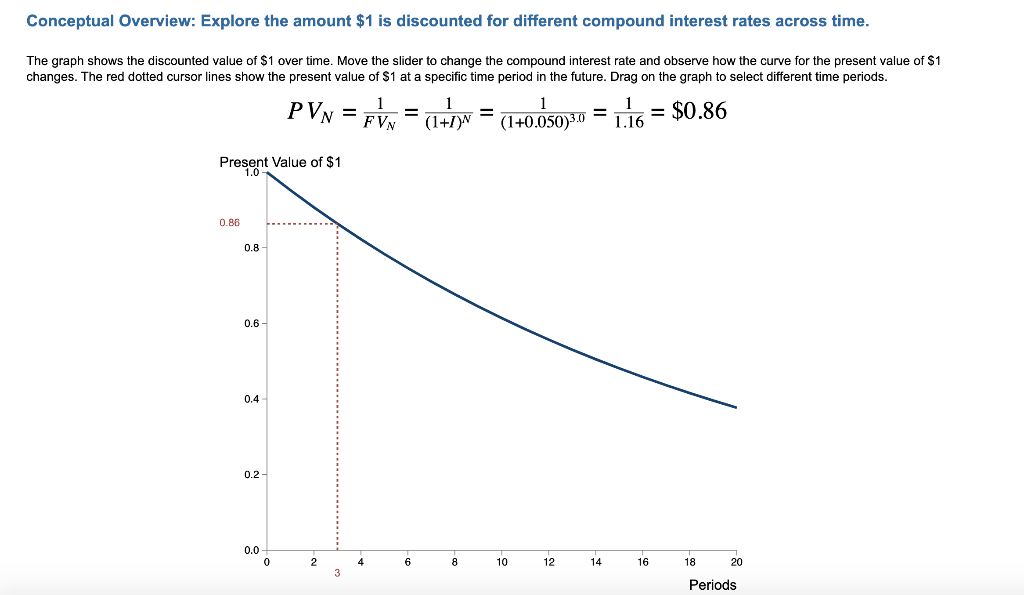

Question: Conceptual Overview: Explore the amount $1 is discounted for different compound interest rates across time. The graph shows the discounted value of $1 over time.

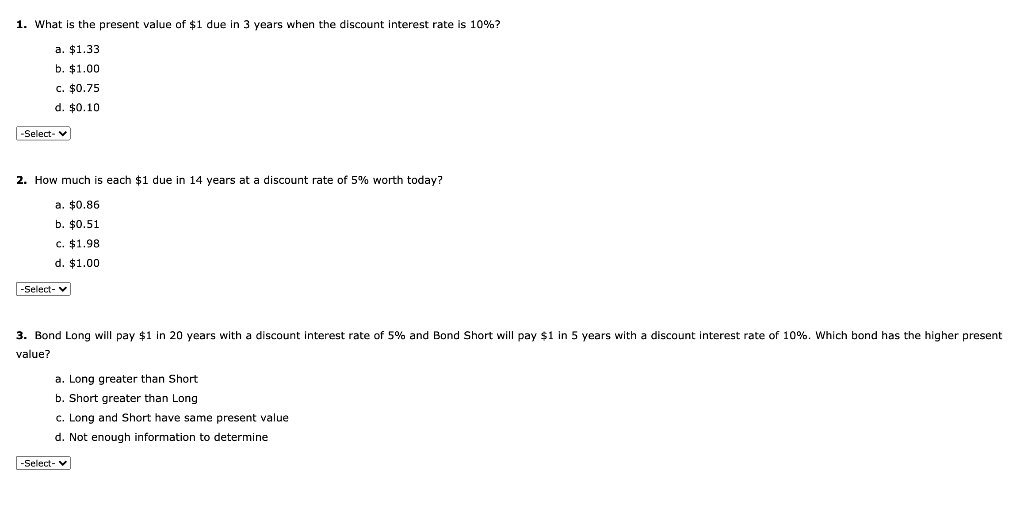

Conceptual Overview: Explore the amount $1 is discounted for different compound interest rates across time. The graph shows the discounted value of $1 over time. Move the slider to change the compound interest rate and observe how the curve for the present value of $1 changes. The red dotted cursor lines show the present value of $1 at a specific time period in the future. Drag on the graph to select different time periods. PVN = FVN 1 = (1+)n = (1+0.050)30 = = $0.86 1.16 Present Value of $1 0.86 0.8 0.6 0.4 0.2 0.0 0 2 4 6 8 10 12 14 16 18 20 3 Periods 1. What is the present value of $1 due in 3 years when the discount interest rate is 10%? a. $1.33 b. $1.00 C. $0.75 d. $0.10 -Select- 2. How much is each $1 due in 14 years at a discount rate of 5% worth today? a. $0.86 b. $0.51 c. $1.98 d. $1.00 -Select- 3. Bond Long will pay $1 in 20 years with a discount interest rate of 5% and Bond Short will pay $1 in 5 years with a discount interest rate of 10%. Which bond has the higher present value? a. Long greater than Short b. Short greater than Long c. Long and short have same present value d. Not enough information to determine -Select

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts