Question: Conch Republic Electronics is a mid sized electronics manufacturer located in Key West, Florida. The company has performed a marketing study to determine the expected

Conch Republic Electronics is a mid sized electronics manufacturer located in Key West, Florida. The company has performed a marketing study to determine the expected sales figures for the new PDA. Conch Republic can manufacture the new PDA for $200 each in variable costs. Fixed costs for the operation are estimated to run $4.5 million per year. The estimated sales volume is 70,000, 80,000, 100,000, 85,000, and 75,000 per each year for the next five years, respectively. The unit price of the new PDA will be $340. The necessary equipment can be purchased for $16.5 million and will be depreciated on a 5 year straight-line schedule. Net working capital investment for the PDAs will be $6,000,000 the first year of operations. Of course NWC will be recovered at the projects end. Conch Republic has a 35 percent corporate tax rate and a 12 percent required return. Shelly has asked Jay to prepare a report that answers the following questions: 1. What is the IRR of the project? 2. What is the NPV of the project, based on the required rate of return of 12%?

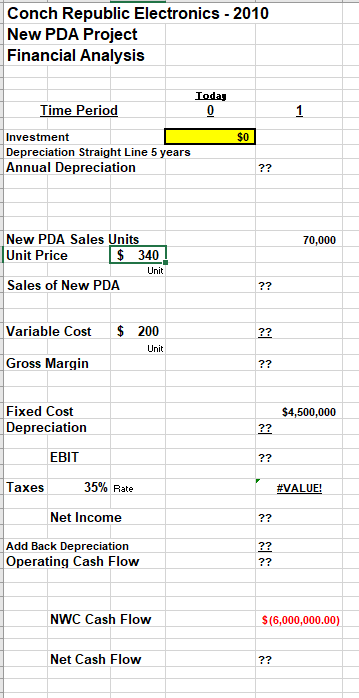

Conch Republic Electronics - 2010 New PDA Project Financial Analysis Time Period Today 0 1 $0 Investment Depreciation Straight Line 5 years Annual Depreciation ?? 70,000 New PDA Sales Units Unit Price $ 340 Unit Sales of New PDA ?? Variable Cost ?? $ 200 Unit Gross Margin ?? $4,500,000 Fixed Cost Depreciation ?? EBIT ?? Taxes 35% Rate #VALUE! Net Income ?? Add Back Depreciation Operating Cash Flow ?? ?? NWC Cash Flow $(6,000,000.00) Net Cash Flow

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts