Question: Conduct a financial analysis Common size,ratio analysis and Du-point analysis of Year 2016 ,financial statements are attached please Tel: +92 (51) 2273457-60/260.4934-37: Fax: +92 (51)

Conduct a financial analysis Common size,ratio analysis and Du-point analysis of Year 2016 ,financial statements are attached please

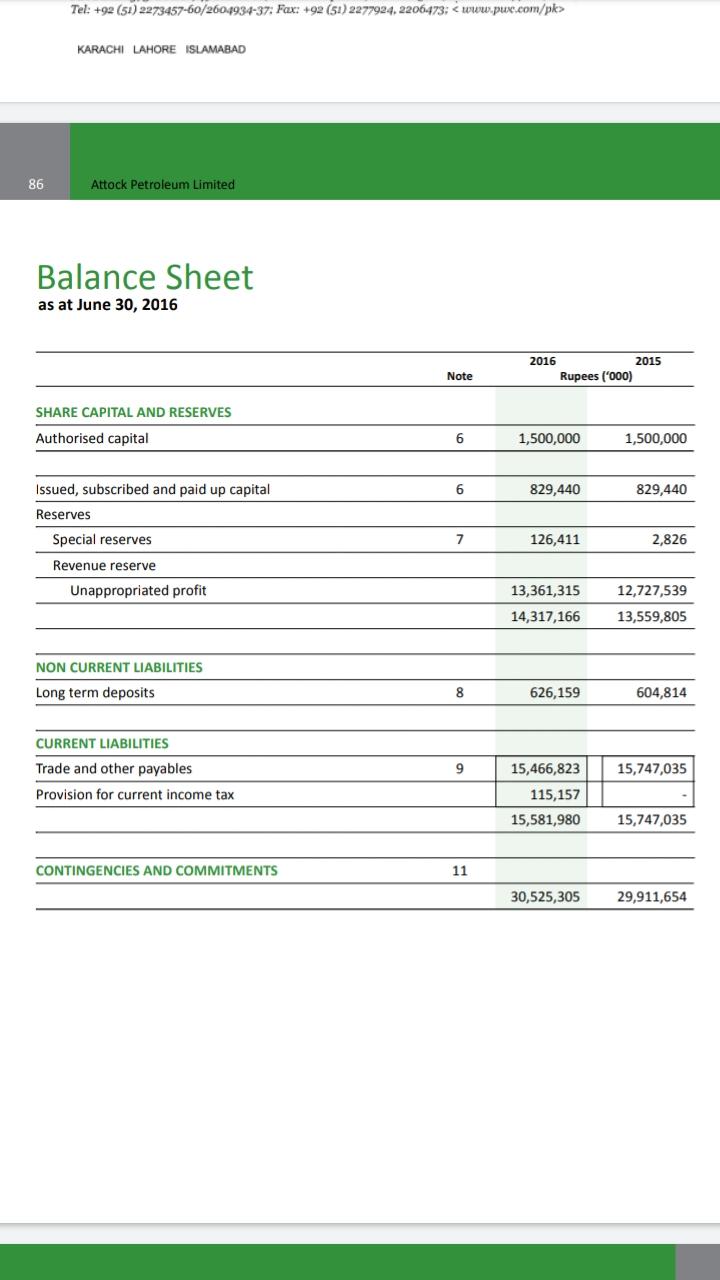

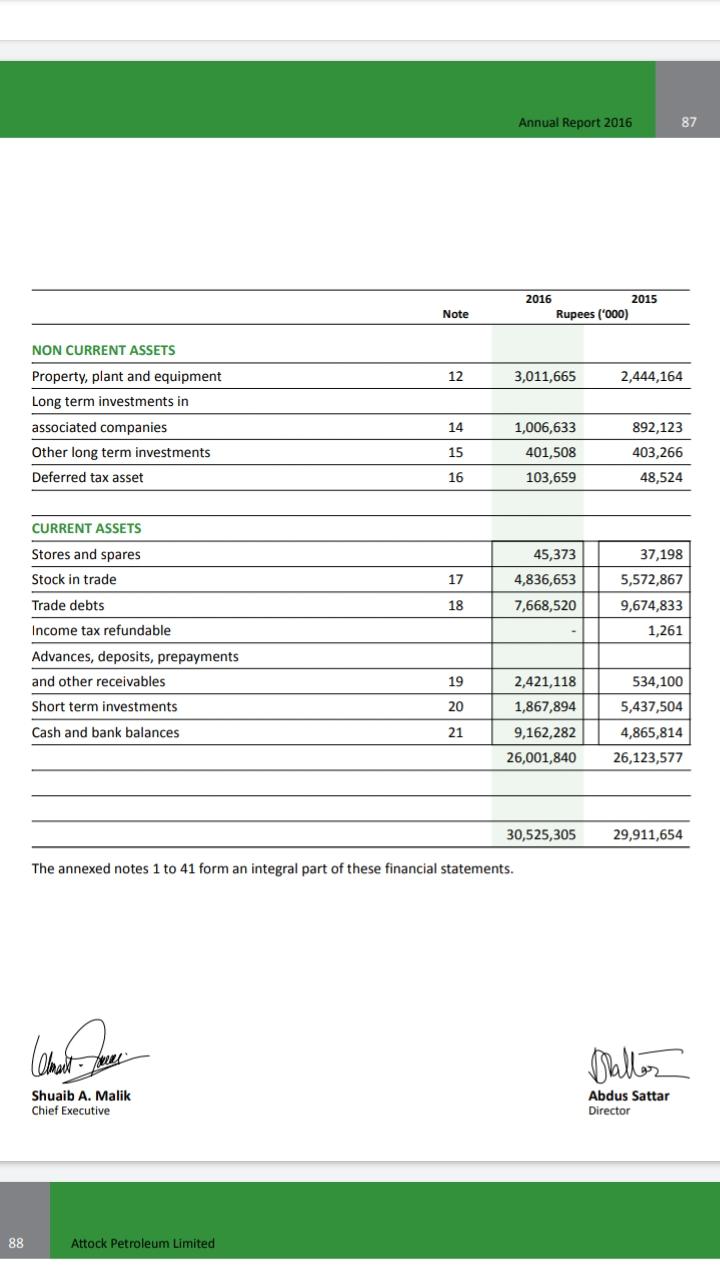

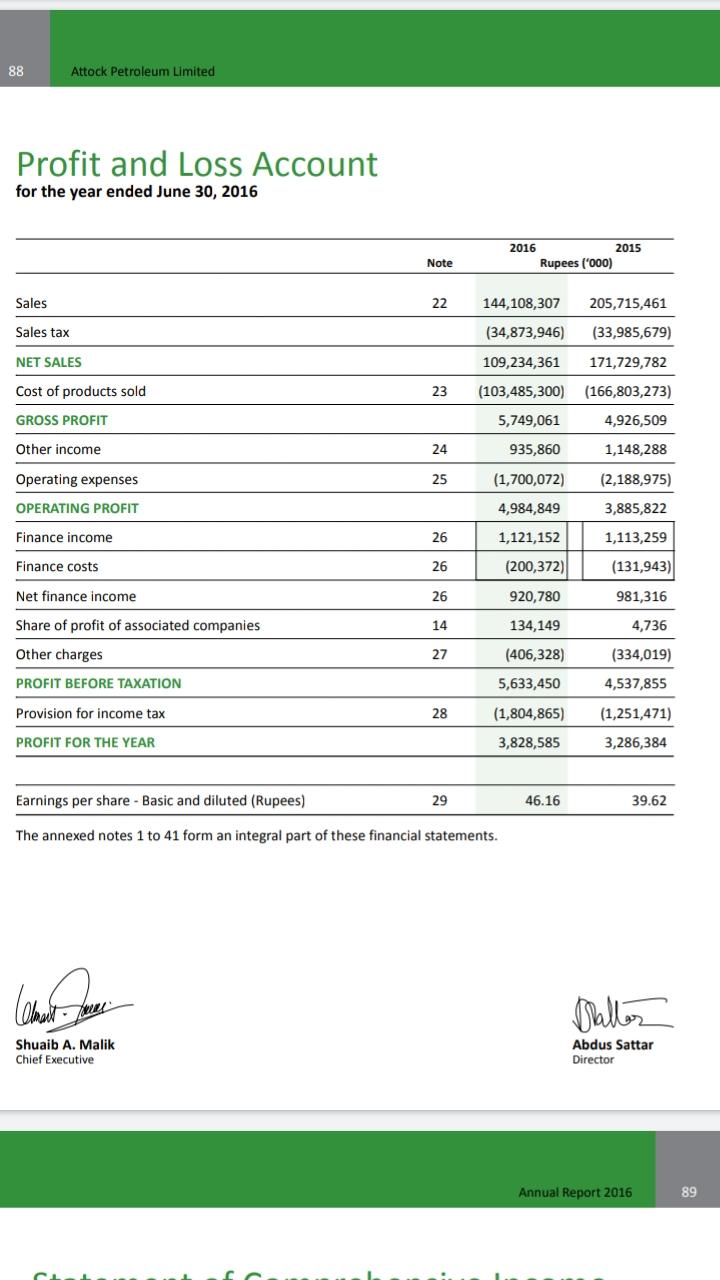

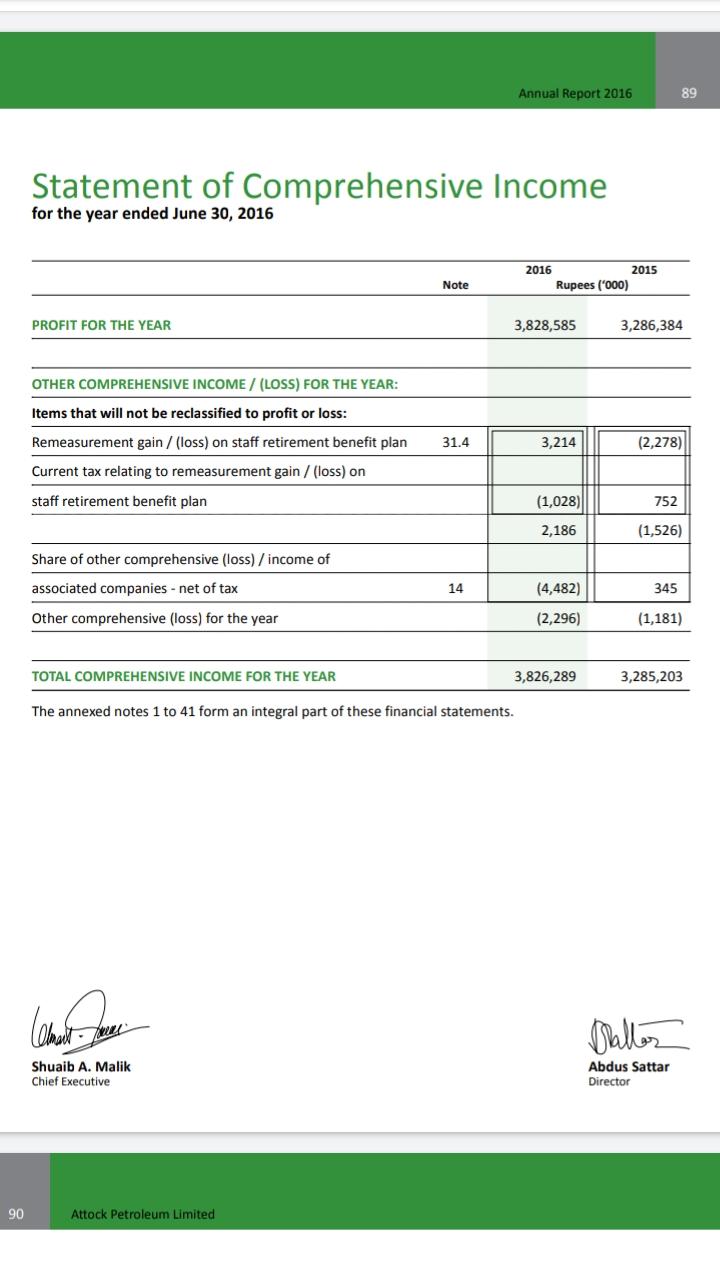

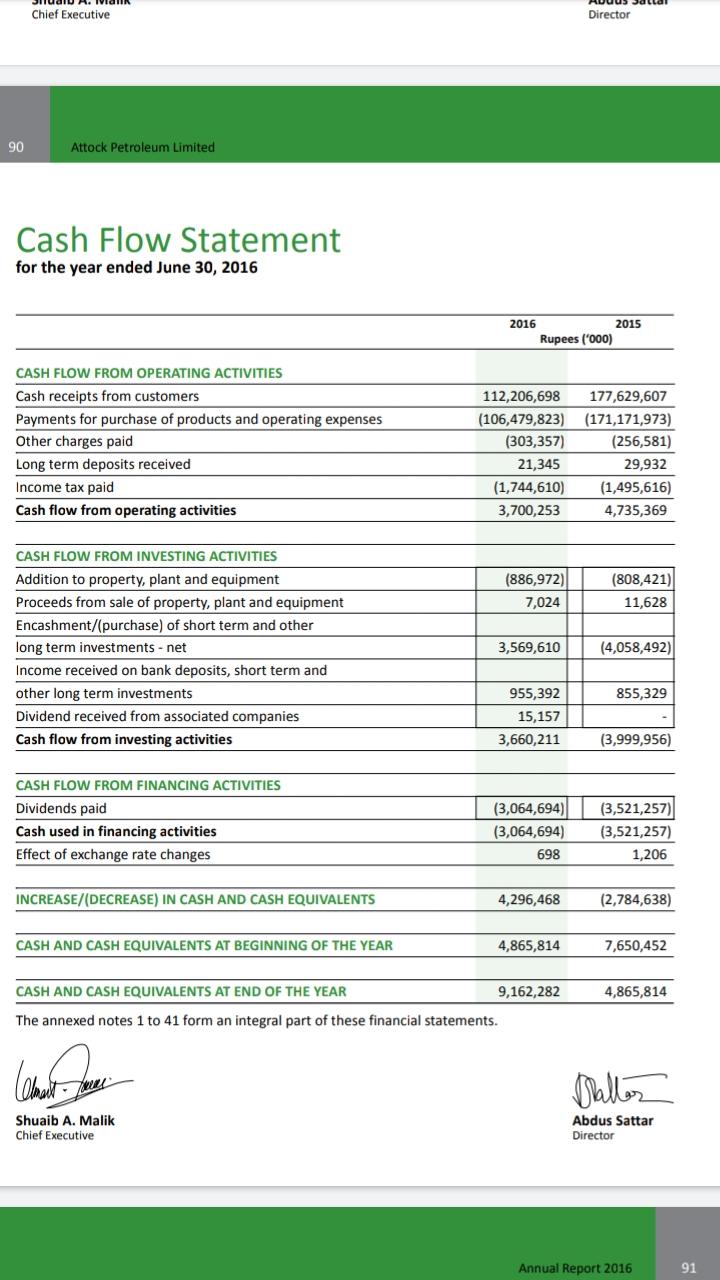

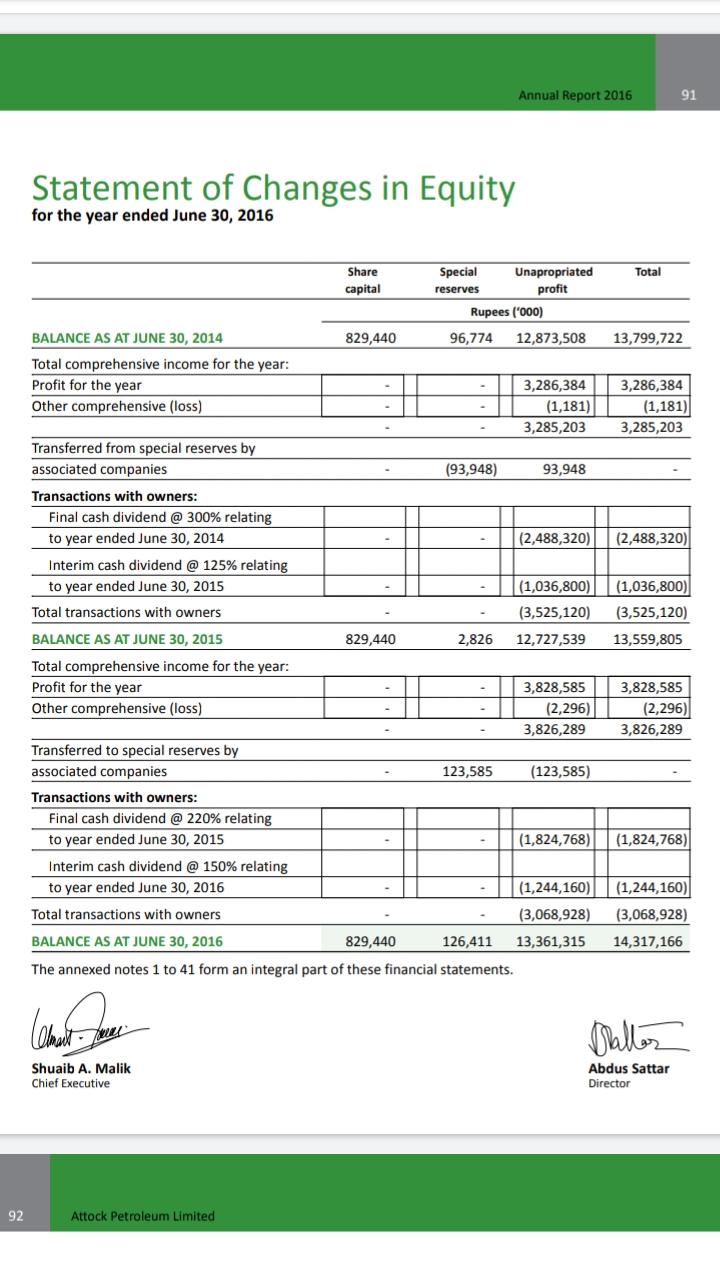

Tel: +92 (51) 2273457-60/260.4934-37: Fax: +92 (51) 2277924.2206473: www.puxe.com/pk> KARACHI LAHORE ISLAMABAD 86 Attock Petroleum Limited Balance Sheet as at June 30, 2016 Note 2016 2015 Rupees ('000) SHARE CAPITAL AND RESERVES Authorised capital 6 1,500,000 1,500,000 Issued, subscribed and paid up capital 6 829,440 829,440 Reserves Special reserves Revenue reserve 7 126,411 2,826 Unappropriated profit 13,361,315 12,727,539 14,317,166 13,559,805 NON CURRENT LIABILITIES Long term deposits 8 626,159 604,814 CURRENT LIABILITIES Trade and other payables 9 15,747,035 Provision for current income tax 15,466,823 115,157 15,581,980 15,747,035 CONTINGENCIES AND COMMITMENTS 11 30,525,305 29,911,654 Annual Report 2016 87 2016 2015 Rupees ('000) Note 12 3,011,665 2,444,164 NON CURRENT ASSETS Property, plant and equipment Long term investments in associated companies Other long term investments Deferred tax asset 14 892,123 15 1,006,633 401,508 103,659 403,266 48,524 16 CURRENT ASSETS 45,373 37,198 Stores and spares Stock in trade 17 4,836,653 5,572,867 Trade debts 18 7,668,520 9,674,833 1,261 Income tax refundable Advances, deposits, prepayments and other receivables Short term investments 19 534,100 20 2,421,118 1,867,894 9,162,282 Cash and bank balances 21 5,437,504 4,865,814 26,123,577 26,001,840 30,525,305 29,911,654 The annexed notes 1 to 41 form an integral part of these financial statements. Chat one Ballar Shuaib A. Malik Chief Executive Abdus Sattar Director 88 Attock Petroleum Limited 88 Attock Petroleum Limited Profit and Loss Account for the year ended June 30, 2016 2016 2015 Rupees ('000) Note Sales 22 144,108,307 205,715,461 (33,985,679) Sales tax (34,873,946) NET SALES 109,234,361 171,729,782 Cost of products sold 23 (166,803,273) (103,485,300) 5,749,061 GROSS PROFIT 4,926,509 Other income 24 935,860 1,148,288 25 (2,188,975) Operating expenses OPERATING PROFIT (1,700,072) 4,984,849 3,885,822 Finance income 26 1,121,152 1,113,259 Finance costs 26 (200,372) (131,943) Net finance income 26 920,780 981,316 Share of profit of associated companies 14 134,149 4,736 Other charges 27 (334,019) (406,328) 5,633,450 PROFIT BEFORE TAXATION 4,537,855 Provision for income tax 28 (1,804,865) (1,251,471) PROFIT FOR THE YEAR 3,828,585 3,286,384 Earnings per share - Basic and diluted (Rupees) 29 46.16 39.62 The annexed notes 1 to 41 form an integral part of these financial statements. Chat one Brallor Shuaib A. Malik Chief Executive Abdus Sattar Director Annual Report 2016 89 Annual Report 2016 89 Statement of Comprehensive Income for the year ended June 30, 2016 Note 2016 2015 Rupees ('000) PROFIT FOR THE YEAR 3,828,585 3,286,384 OTHER COMPREHENSIVE INCOME / (LOSS) FOR THE YEAR: Items that will not be reclassified to profit or loss: Remeasurement gain / (loss) on staff retirement benefit plan Current tax relating to remeasurement gain / (loss) on staff retirement benefit plan 31.4 3,214 (2,278) (1,028) 752 2,186 (1,526) Share of other comprehensive (loss) / income of associated companies - net of tax Other comprehensive (loss) for the year 14 (4,482) 345 (2,296) (1,181) TOTAL COMPREHENSIVE INCOME FOR THE YEAR 3,826,289 3,285,203 The annexed notes 1 to 41 form an integral part of these financial statements. Cameron Ballar Shuaib A. Malik Chief Executive Abdus Sattar Director 90 Attock Petroleum Limited Chief Executive Director 90 Attock Petroleum Limited Cash Flow Statement for the year ended June 30, 2016 2016 2015 Rupees ('000) CASH FLOW FROM OPERATING ACTIVITIES Cash receipts from customers Payments for purchase of products and operating expenses Other charges paid Long term deposits received Income tax paid Cash flow from operating activities 112,206,698 (106,479,823) (303,357) 21,345 (1,744,610) 3,700,253 177,629,607 (171,171,973) (256,581) 29,932 (1,495,616) 4,735,369 (886,972) 7,024 (808,421) 11,628 CASH FLOW FROM INVESTING ACTIVITIES Addition to property, plant and equipment Proceeds from sale of property, plant and equipment Encashment/(purchase) of short term and other long term investments - net Income received on bank deposits, short term and other long term investments Dividend received from associated companies Cash flow from investing activities 3,569,610 (4,058,492) 855,329 955,392 15,157 3,660,211 (3,999,956) CASH FLOW FROM FINANCING ACTIVITIES Dividends paid Cash used in financing activities Effect of exchange rate changes (3,064,694) (3,064,694) 698 (3,521,257) (3,521,257) 1,206 INCREASE/DECREASE) IN CASH AND CASH EQUIVALENTS 4,296,468 (2,784,638) CASH AND CASH EQUIVALENTS AT BEGINNING OF THE YEAR 4,865,814 7,650,452 4,865,814 CASH AND CASH EQUIVALENTS AT END OF THE YEAR 9,162,282 The annexed notes 1 to 41 form an integral part of these financial statements. lahan Baller Shuaib A. Malik Chief Executive Abdus Sattar Director Annual Report 2016 91 Annual Report 2016 91 Statement of Changes in Equity for the year ended June 30, 2016 Total Share capital Special Unapropriated reserves profit Rupees ('000) 13,799,722 3,286,384 (1,181) 3,285,203 (2,488,320) (1,036,800) (3,525,120) 13,559,805 BALANCE AS AT JUNE 30, 2014 829,440 96,774 12,873,508 Total comprehensive income for the year: Profit for the year 3,286,384 Other comprehensive (loss) (1,181) 3,285,203 Transferred from special reserves by associated companies (93,948) 93,948 Transactions with owners: Final cash dividend @ 300% relating to year ended June 30, 2014 (2,488,320) Interim cash dividend @ 125% relating to year ended June 30, 2015 (1,036,800) Total transactions with owners (3,525,120) BALANCE AS AT JUNE 30, 2015 829,440 2,826 12,727,539 Total comprehensive income for the year: Profit for the year 3,828,585 Other comprehensive (loss) (2,296) 3,826,289 Transferred to special reserves by associated companies 123,585 (123,585) Transactions with owners: Final cash dividend @ 220% relating to year ended June 30, 2015 (1,824,768) Interim cash dividend @ 150% relating to year ended June 30, 2016 (1,244,160) Total transactions with owners (3,068,928) BALANCE AS AT JUNE 30, 2016 829,440 126,411 13,361,315 The annexed notes 1 to 41 form an integral part of these financial statements. 3,828,585 (2,296) 3,826,289 (1,824,768) (1,244,160) (3,068,928) 14,317,166 Chat. Di Brallor Shuaib A. Malik Chief Executive Abdus Sattar Director 92 Attock Petroleum Limited Tel: +92 (51) 2273457-60/260.4934-37: Fax: +92 (51) 2277924.2206473: www.puxe.com/pk> KARACHI LAHORE ISLAMABAD 86 Attock Petroleum Limited Balance Sheet as at June 30, 2016 Note 2016 2015 Rupees ('000) SHARE CAPITAL AND RESERVES Authorised capital 6 1,500,000 1,500,000 Issued, subscribed and paid up capital 6 829,440 829,440 Reserves Special reserves Revenue reserve 7 126,411 2,826 Unappropriated profit 13,361,315 12,727,539 14,317,166 13,559,805 NON CURRENT LIABILITIES Long term deposits 8 626,159 604,814 CURRENT LIABILITIES Trade and other payables 9 15,747,035 Provision for current income tax 15,466,823 115,157 15,581,980 15,747,035 CONTINGENCIES AND COMMITMENTS 11 30,525,305 29,911,654 Annual Report 2016 87 2016 2015 Rupees ('000) Note 12 3,011,665 2,444,164 NON CURRENT ASSETS Property, plant and equipment Long term investments in associated companies Other long term investments Deferred tax asset 14 892,123 15 1,006,633 401,508 103,659 403,266 48,524 16 CURRENT ASSETS 45,373 37,198 Stores and spares Stock in trade 17 4,836,653 5,572,867 Trade debts 18 7,668,520 9,674,833 1,261 Income tax refundable Advances, deposits, prepayments and other receivables Short term investments 19 534,100 20 2,421,118 1,867,894 9,162,282 Cash and bank balances 21 5,437,504 4,865,814 26,123,577 26,001,840 30,525,305 29,911,654 The annexed notes 1 to 41 form an integral part of these financial statements. Chat one Ballar Shuaib A. Malik Chief Executive Abdus Sattar Director 88 Attock Petroleum Limited 88 Attock Petroleum Limited Profit and Loss Account for the year ended June 30, 2016 2016 2015 Rupees ('000) Note Sales 22 144,108,307 205,715,461 (33,985,679) Sales tax (34,873,946) NET SALES 109,234,361 171,729,782 Cost of products sold 23 (166,803,273) (103,485,300) 5,749,061 GROSS PROFIT 4,926,509 Other income 24 935,860 1,148,288 25 (2,188,975) Operating expenses OPERATING PROFIT (1,700,072) 4,984,849 3,885,822 Finance income 26 1,121,152 1,113,259 Finance costs 26 (200,372) (131,943) Net finance income 26 920,780 981,316 Share of profit of associated companies 14 134,149 4,736 Other charges 27 (334,019) (406,328) 5,633,450 PROFIT BEFORE TAXATION 4,537,855 Provision for income tax 28 (1,804,865) (1,251,471) PROFIT FOR THE YEAR 3,828,585 3,286,384 Earnings per share - Basic and diluted (Rupees) 29 46.16 39.62 The annexed notes 1 to 41 form an integral part of these financial statements. Chat one Brallor Shuaib A. Malik Chief Executive Abdus Sattar Director Annual Report 2016 89 Annual Report 2016 89 Statement of Comprehensive Income for the year ended June 30, 2016 Note 2016 2015 Rupees ('000) PROFIT FOR THE YEAR 3,828,585 3,286,384 OTHER COMPREHENSIVE INCOME / (LOSS) FOR THE YEAR: Items that will not be reclassified to profit or loss: Remeasurement gain / (loss) on staff retirement benefit plan Current tax relating to remeasurement gain / (loss) on staff retirement benefit plan 31.4 3,214 (2,278) (1,028) 752 2,186 (1,526) Share of other comprehensive (loss) / income of associated companies - net of tax Other comprehensive (loss) for the year 14 (4,482) 345 (2,296) (1,181) TOTAL COMPREHENSIVE INCOME FOR THE YEAR 3,826,289 3,285,203 The annexed notes 1 to 41 form an integral part of these financial statements. Cameron Ballar Shuaib A. Malik Chief Executive Abdus Sattar Director 90 Attock Petroleum Limited Chief Executive Director 90 Attock Petroleum Limited Cash Flow Statement for the year ended June 30, 2016 2016 2015 Rupees ('000) CASH FLOW FROM OPERATING ACTIVITIES Cash receipts from customers Payments for purchase of products and operating expenses Other charges paid Long term deposits received Income tax paid Cash flow from operating activities 112,206,698 (106,479,823) (303,357) 21,345 (1,744,610) 3,700,253 177,629,607 (171,171,973) (256,581) 29,932 (1,495,616) 4,735,369 (886,972) 7,024 (808,421) 11,628 CASH FLOW FROM INVESTING ACTIVITIES Addition to property, plant and equipment Proceeds from sale of property, plant and equipment Encashment/(purchase) of short term and other long term investments - net Income received on bank deposits, short term and other long term investments Dividend received from associated companies Cash flow from investing activities 3,569,610 (4,058,492) 855,329 955,392 15,157 3,660,211 (3,999,956) CASH FLOW FROM FINANCING ACTIVITIES Dividends paid Cash used in financing activities Effect of exchange rate changes (3,064,694) (3,064,694) 698 (3,521,257) (3,521,257) 1,206 INCREASE/DECREASE) IN CASH AND CASH EQUIVALENTS 4,296,468 (2,784,638) CASH AND CASH EQUIVALENTS AT BEGINNING OF THE YEAR 4,865,814 7,650,452 4,865,814 CASH AND CASH EQUIVALENTS AT END OF THE YEAR 9,162,282 The annexed notes 1 to 41 form an integral part of these financial statements. lahan Baller Shuaib A. Malik Chief Executive Abdus Sattar Director Annual Report 2016 91 Annual Report 2016 91 Statement of Changes in Equity for the year ended June 30, 2016 Total Share capital Special Unapropriated reserves profit Rupees ('000) 13,799,722 3,286,384 (1,181) 3,285,203 (2,488,320) (1,036,800) (3,525,120) 13,559,805 BALANCE AS AT JUNE 30, 2014 829,440 96,774 12,873,508 Total comprehensive income for the year: Profit for the year 3,286,384 Other comprehensive (loss) (1,181) 3,285,203 Transferred from special reserves by associated companies (93,948) 93,948 Transactions with owners: Final cash dividend @ 300% relating to year ended June 30, 2014 (2,488,320) Interim cash dividend @ 125% relating to year ended June 30, 2015 (1,036,800) Total transactions with owners (3,525,120) BALANCE AS AT JUNE 30, 2015 829,440 2,826 12,727,539 Total comprehensive income for the year: Profit for the year 3,828,585 Other comprehensive (loss) (2,296) 3,826,289 Transferred to special reserves by associated companies 123,585 (123,585) Transactions with owners: Final cash dividend @ 220% relating to year ended June 30, 2015 (1,824,768) Interim cash dividend @ 150% relating to year ended June 30, 2016 (1,244,160) Total transactions with owners (3,068,928) BALANCE AS AT JUNE 30, 2016 829,440 126,411 13,361,315 The annexed notes 1 to 41 form an integral part of these financial statements. 3,828,585 (2,296) 3,826,289 (1,824,768) (1,244,160) (3,068,928) 14,317,166 Chat. Di Brallor Shuaib A. Malik Chief Executive Abdus Sattar Director 92 Attock Petroleum Limited

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts