Question: Conflicts between two mutually exclusive projects occasionally occur, where the NPV method ranks one project higher but the IRR method ranks the other one. Such

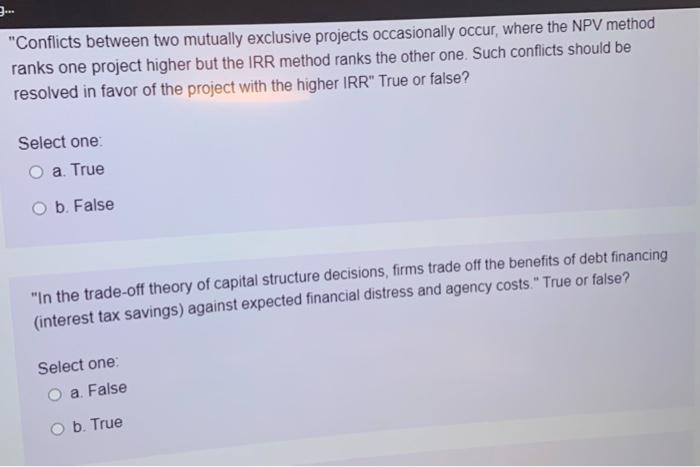

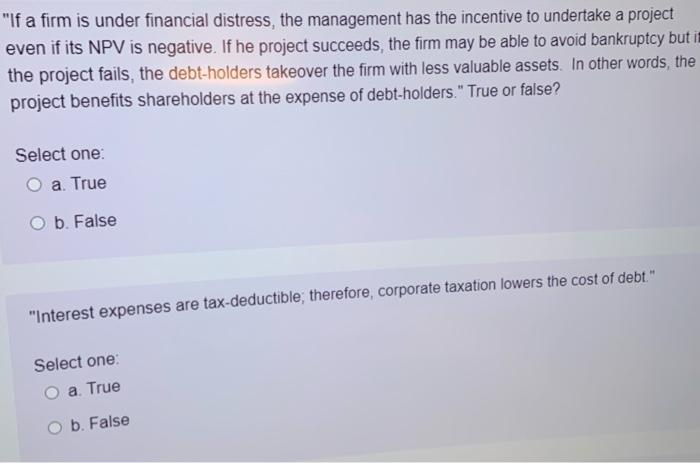

"Conflicts between two mutually exclusive projects occasionally occur, where the NPV method ranks one project higher but the IRR method ranks the other one. Such conflicts should be resolved in favor of the project with the higher IRR" True or false? Select one: O a. True O b. False "In the trade-off theory of capital structure decisions, firms trade off the benefits of debt financing (interest tax savings) against expected financial distress and agency costs." True or false? Select one: O a. False b. True "If a firm is under financial distress, the management has the incentive to undertake a project even if its NPV is negative. If he project succeeds the firm may be able to avoid bankruptcy but in the project fails, the debt-holders takeover the firm with less valuable assets. In other words, the project benefits shareholders at the expense of debt-holders." True or false? Select one: a. True O b. False "Interest expenses are tax-deductible, therefore, corporate taxation lowers the cost of debt." Select one: a True O b. False

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts