Question: Confused on the adjustments. Where do we get the values for the new balance sheet, income statements, t-tables, etc... Applying the Entire Accounting Cycle Rhoades

Confused on the adjustments. Where do we get the values for the new balance sheet, income statements, t-tables, etc...

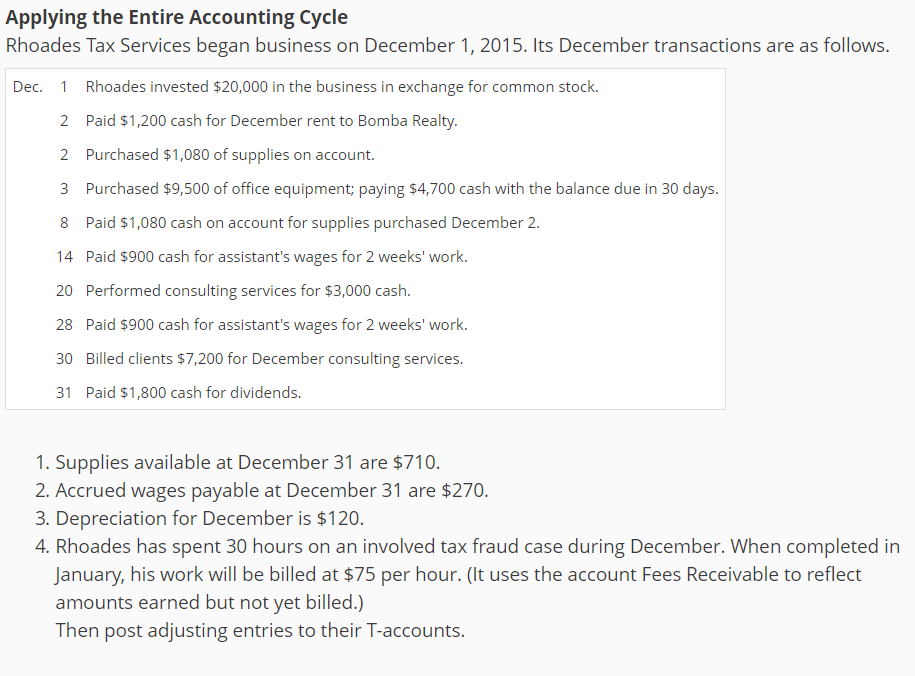

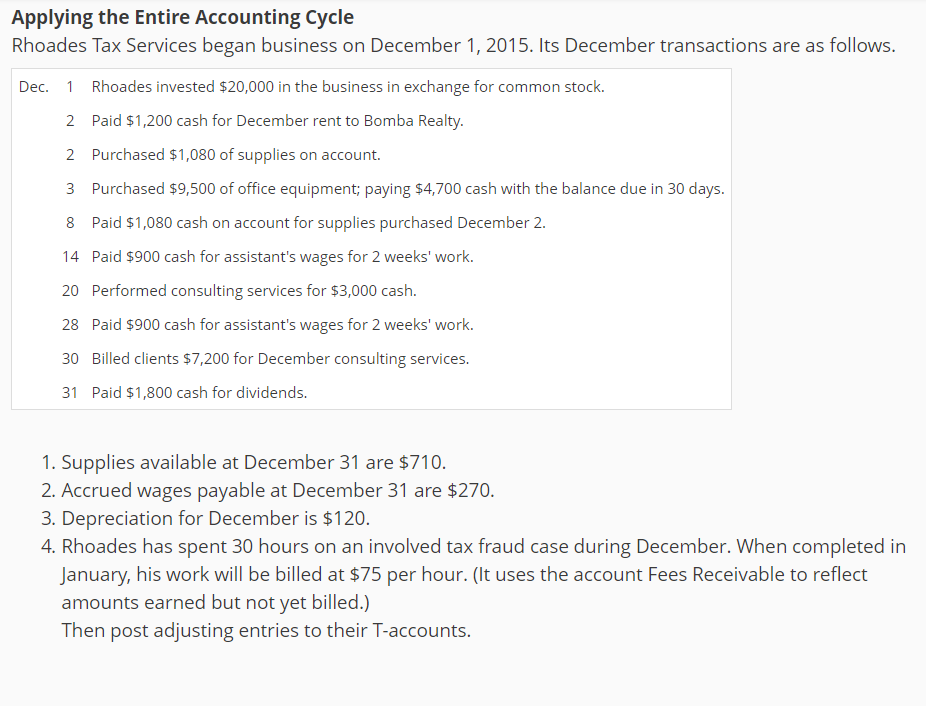

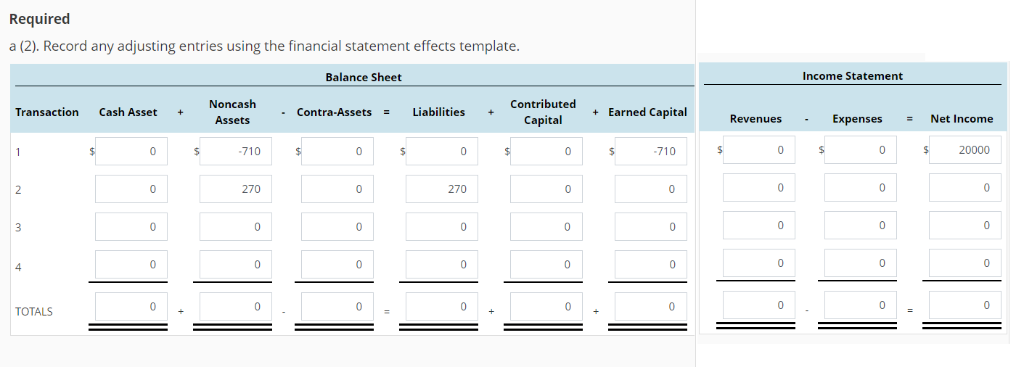

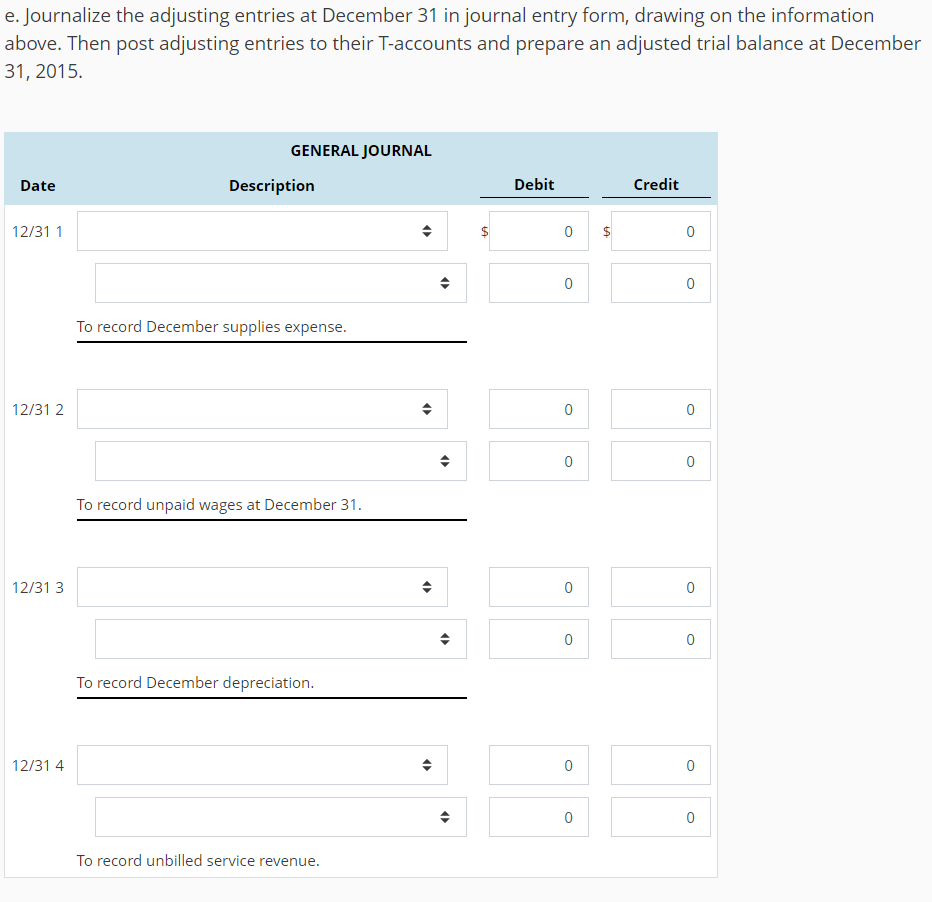

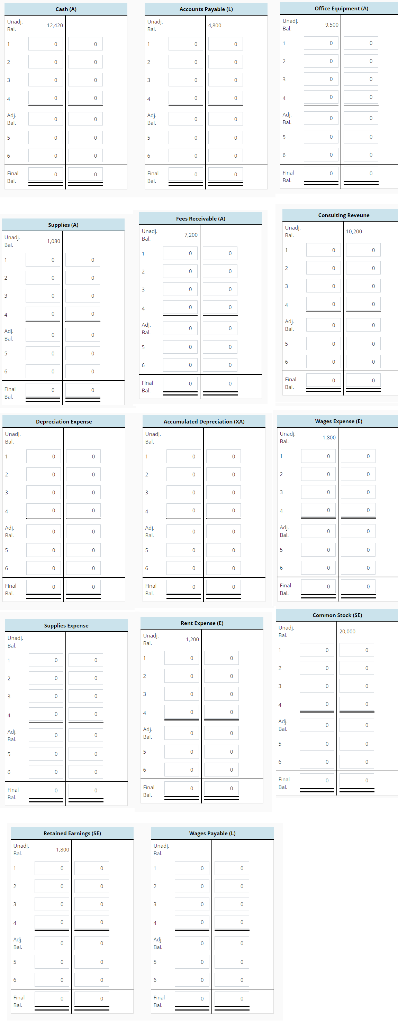

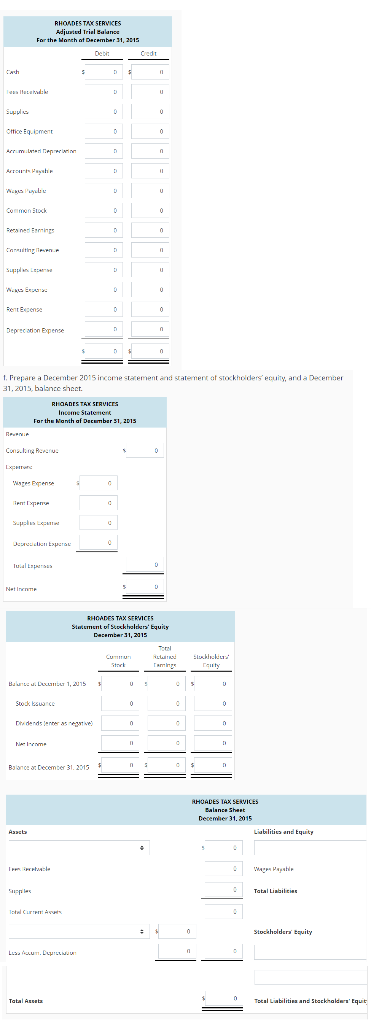

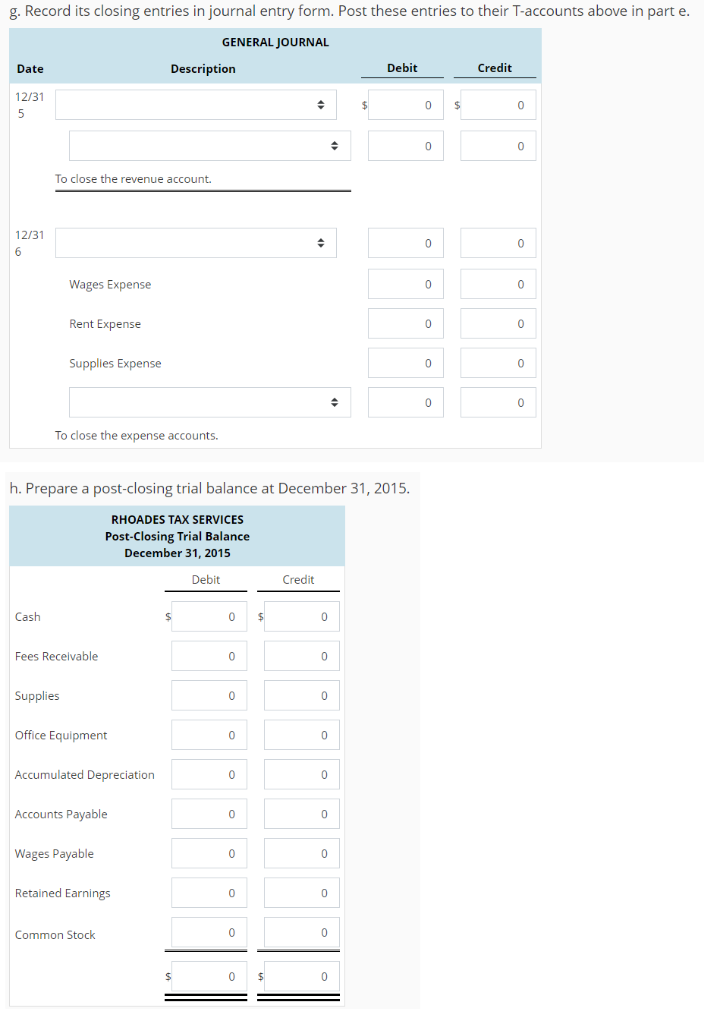

Applying the Entire Accounting Cycle Rhoades Tax Services began business on December 1, 2015. Its December transactions are as follows. Dec. 1 Rhoades invested $20,000 in the business in exchange for common stock 2 Paid $1,200 cash for December rent to Bomba Realty. 2 Purchased $1,080 of supplies on account 3 Purchased $9,500 of office equipment; paying $4,700 cash with the balance due in 30 days 8 Paid $1,080 cash on account for supplies purchased December 2. 14 Paid $900 cash for assistant's wages for 2 weeks' work 20 Performed consulting services for $3,000 cash. 28 Paid $900 cash for assistant's wages for 2 weeks' work. 30 Billed clients $7,200 for December consulting services 31 Paid $1,800 cash for dividends. 1. Supplies available at December 31 are $710 2. Accrued wages payable at December 31 are $270. 3. Depreciation for December is $120. 4. Rhoades has spent 30 hours on an involved tax fraud case during December. When completed in January, his work will be billed at $75 per hour. (It uses the account Fees Receivable to reflect amounts earned but not yet billed.) Then post adjusting entries to their T-accounts. Applying the Entire Accounting Cycle Rhoades Tax Services began business on December 1, 2015. Its December transactions are as follows. Dec. 1 Rhoades invested $20,000 in the business in exchange for common stock 2 Paid $1,200 cash for December rent to Bomba Realty. 2 Purchased $1,080 of supplies on account. 3 Purchased $9,500 of office equipment; paying $4,700 cash with the balance due in 30 days. 8 Paid $1,080 cash on account for supplies purchased December 2. 14 Paid $900 cash for assistant's wages for 2 weeks' work 20 Performed consulting services for $3,000 cash. 28 Paid $900 cash for assistant's wages for 2 weeks' work. 30 Billed clients $7,200 for December consulting services. 31 Paid $1,800 cash for dividends. 1. Supplies available at December 31 are $710 2. Accrued wages payable at December 31 are $270 3. Depreciation for December is $120. 4. Rhoades has spent 30 hours on an involved tax fraud case during December. When completed in January, his work will be billed at $75 per hour. (It uses the account Fees Receivable to reflect arnounis arncd ut noi y billd.) Then post adjusting entries to their T-accounts. Required a (2). Record any adjusting entries using the financial statement effects template Balance Sheet Income Statement Contributed Noncash Assets Transaction Cash Asset+ Contra-Assets= Liabilities + Earned Capital Capital Revenues Expenses = Net Income 710 710 $20000 270 270 TOTALS e. Journalize the adjusting entries at December 31 in journal entry form, drawing on the information ab.01 5hen post adsting entries to ther ccounts and prepalance at December GENERAL JOURNAL Date Description Debit Credit 2/31 1 0 0 To record December supplies expense 12/31 2 0 0 0 0 To record unpaid wages at December 31 2/31 3 0 0 To record December depreciation 12/31 4 0 0 To record unbilled service revenue. Adjuated Triel Balanee Credt Common Etock Bent Ece Deprec adion Epense . Frepare a December 205 inceme sement and sratemen at stockholders ecuity, andaDcemaer 31,2015, balnc shect For the Nanth af Decumber 51, 2015 Decemhe31. 2015 Liabilitics and tqut Tocal Labilitisa and Sckad qut g. Record its closing entries in journal entry form. Post these entries to their T-accounts above in part e GENERAL JOURNAL Date Description Debit Credit 12/31 0 To close the revenue account 12/31 Wages Expense Rent Expense Supplies Expense To close the expense accounts. h. Prepare a post-closing trial balance at December 31, 2015 RHOADES TAX SERVICES Post-Closing Trial Balance December 31, 2015 Debit Credit Cash Fees Recelvable Supplies Office Equipment Accumulated Depreciation Accounts Payable Wages Payable Retained Earnings 0 Common Stock

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts