Question: Connect Account Downloads Mal cbutterman@liberty.edu ? https:// tml in Chapter 9 6 Help Save& Exit Submit Check my work 9 Better Mousetraps has developed a

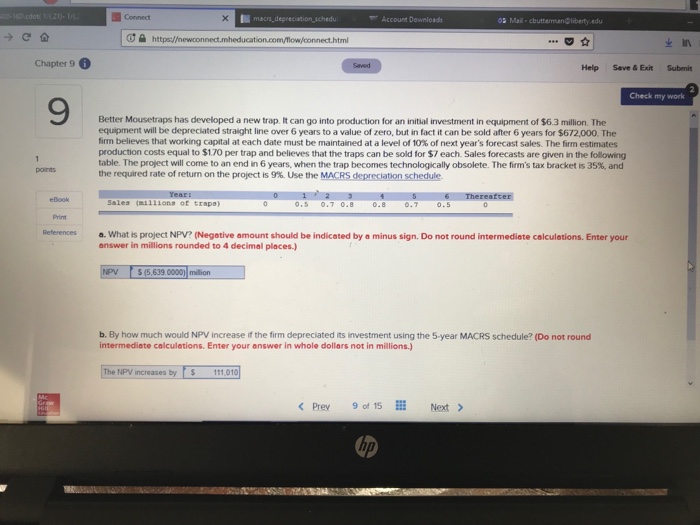

Connect Account Downloads Mal cbutterman@liberty.edu ? https:// tml in Chapter 9 6 Help Save& Exit Submit Check my work 9 Better Mousetraps has developed a new trap. It can go into production for an initial investment in equipment of $63 million. The equipment will be depreciated straight line over 6 years to a value of zero, but in fact it can be sold after 6 years for $672,000. The firm believes that working capital at each date must be maintained at a level of 10% of next year's forecast sales. The firm estimates production costs equal to $170 per trap and believes that the traps can be sold for $7 each. Sales forecasts are given in the following table. The project will come to an end in 6 years, when the trap becomes technologically obsolete. The firm's tax bracket is 35% and the required rate of return on the project is 9%. Use the MACRSdeprecationschedule. points Sales (m:11ions of traps) o.s o.70.8 0.8 ?.7 0.5 References a. What is project NPV? (Negative amount should be indicated by a minus sign. Do not round intermediate calculations. Enter your answer in millions rounded to 4 decimal places) NPV $(5.639 0000 mlion b. By how much would NPV increase if the firm depreciated its investment using the 5-year MACRS schedule? (Do not round intermediate colculations. Enter your answer in whole dollars not in millions.) The NPV increases by S11101 9of15 ill Next >

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts