Question: Connect Get Homework Help With Chega Study I Chegg.com how do you screenshot on a matose activity-based costing to calculate the cost... Seved Help Save

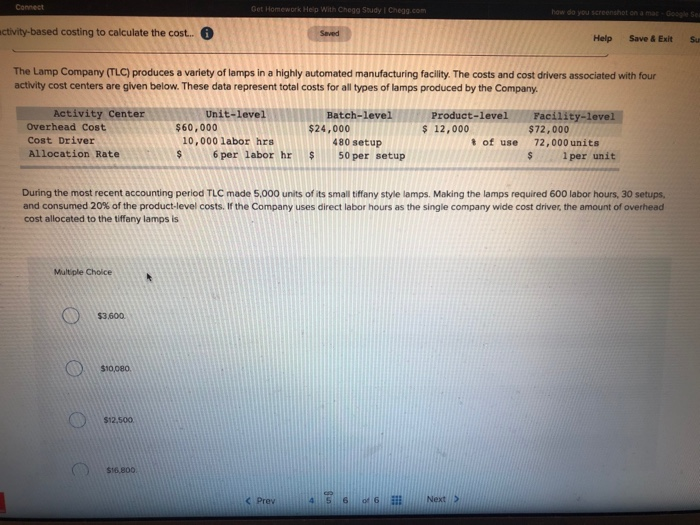

Connect Get Homework Help With Chega Study I Chegg.com how do you screenshot on a matose activity-based costing to calculate the cost... Seved Help Save & Exit Su The Lamp Company (TLC) produces a variety of lamps in a highly automated manufacturing facility. The costs and cost drivers associated with four activity cost centers are given below. These data represent total costs for all types of lamps produced by the Company. Activity Center Unit-level Batch-level Product-level Facility-level Overhead Cost $60,000 $24,000 $ 12,000 $72,000 Cost Driver 10,000 labor hrs 480 setup 72,000 units Allocation Rate 6 per labor hr $ 50 per setup 1 per unit # of use $ $ During the most recent accounting period TLC made 5,000 units of its small tiffany style lamps. Making the lamps required 600 labor hours, 30 setups. and consumed 20% of the product-level costs. If the Company uses direct labor hours as the single company wide cost driver the amount of overhead cost allocated to the tiffany lamps is Multiple Choice $3,600 $10,080 $12.500 $16.800

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts