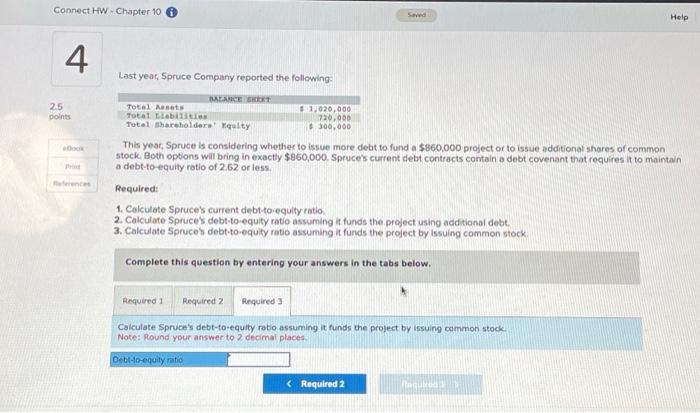

Question: Connect HW - Chapter 10 i 4 2.5 points eBook Print References Last year, Spruce Company reported the following: BALANCE SHEET Total Assets Total Liabilities

Connect HW - Chapter 10 i 4 2.5 points eBook Print References Last year, Spruce Company reported the following: BALANCE SHEET Total Assets Total Liabilities Total Shareholders' Equity $ 1,020,000 720,000 $ 300,000 Saved This year, Spruce is considering whether to issue more debt to fund a $860,000 project or to issue additional shares of common stock. Both options will bring in exactly $860,000. Spruce's current debt contracts contain a debt covenant that requires it to maintain a debt-to-equity ratio of 2.62 or less. Required: 1. Calculate Spruce's current debt-to-equity ratio. 2. Calculate Spruce's debt-to-equity ratio assuming it funds the project using additional debt. 3. Calculate Spruce's debt-to-equity ratio assuming it funds the project by issuing common stock. Required 1 Required 2 Required 3 Complete this question by entering your answers in the tabs below. Calculate Spruce's debt-to-equity ratio assuming it funds the project by issuing common stock. Note: Round your answer to 2 decimal places. Debt-to-equity ratio

Last year, Spruce Company reported the following: This yeat, Spruce is considering whether to issue more debt to fund a $860,000 project or to issue additional shares of common stock. Both options will bring in exactly $960,000. Spruce's current debt contracts contain a debt covenant that requires it to maintain a debt-to-equity ratio of 2.62 or less. Required: 1. Calculate Spruce's current debt-to-equity ratio. 2. Calculate Spruces debt-to-equity ratio assuming it funds the project using additional debt. 3. Calculate Spruces debt-to-equity ratio assuming it funds the project by issuing common stock. Complete this question by entering your answers in the tabs below. Calculate Spruce's debt-to-equity ratio assuming it funds the project by issuing common stock Note: Round your answer to 2 decimal places

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock