Question: conplete answer please In its first year of operations a company produced and sold 70,000 units of Product A sta selling price of $20 per

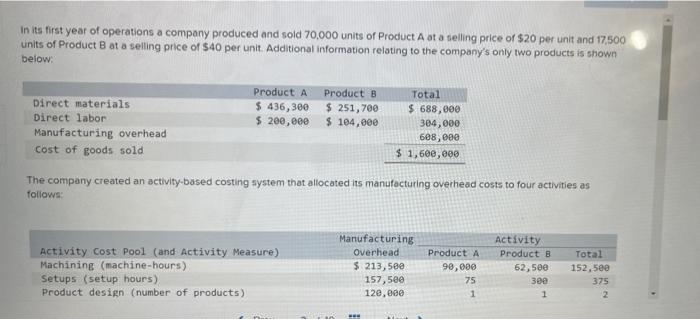

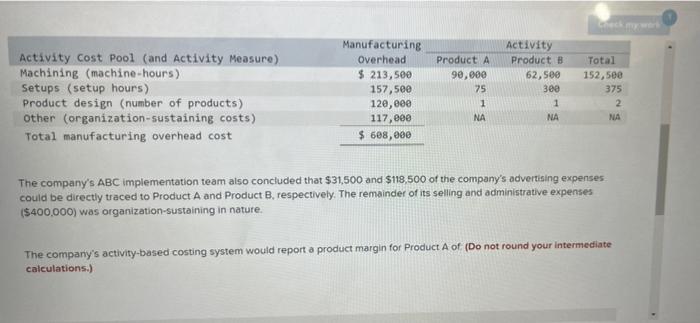

In its first year of operations a company produced and sold 70,000 units of Product A sta selling price of $20 per unit and 17,500 units of Product B at a selling price of $40 per unit. Additional information relating to the company's only two products is shown below: Direct materials Direct labor Manufacturing overhead cost of goods sold Product A Product B $ 436, 380 $ 251,700 $ 200,000 $104,600 Total $ 688,000 304,000 688,000 $ 1,600,000 The company created an activity-based costing system that allocated its manufacturing overhead costs to four activities as follows: Activity Cost Pool (and Activity Measure) Machining (machine-hours) Setups (setup hours) Product design (number of products) Manufacturing Overhead $ 213,500 157,500 120,000 Product A 90,000 75 1 Activity Product B 62,50 380 Total 152,500 375 2 Activity Cost Pool (and Activity Measure) Machining (machine-hours) Setups (setup hours) Product design (number of products) Other (organization-sustaining costs) Total manufacturing overhead cost Manufacturing Overhead $ 213,500 157,500 120,000 117,000 $ 688,000 Product A 90,000 75 1 NA Activity Products 62,500 300 1 NA Total 152,500 375 2 NA The company's ABC implementation team also concluded that $31,500 and $118,500 of the company's advertising expenses could be directly traced to Product A and Product B, respectively. The remainder of its selling and administrative expenses ($400,000) was organization-sustaining in nature. The company's activity-based costing system would report a product margin for Product A of (Do not round your intermediate calculations.) Multiple Choice $533,700 $564 700 $544,700 $514.700

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts