Question: Consider 2 different EN 6 pass - throughs backed by new 3 0 yr mortgages ( 3 6 0 m o to maturity ) .

Consider different EN passthroughs backed by new yr mortgages to maturity with two different groups of underlying borrowers, group and group We will refer to the passthrough backed by bonrower group as bond and the passthrough backed by bonower group as bond :

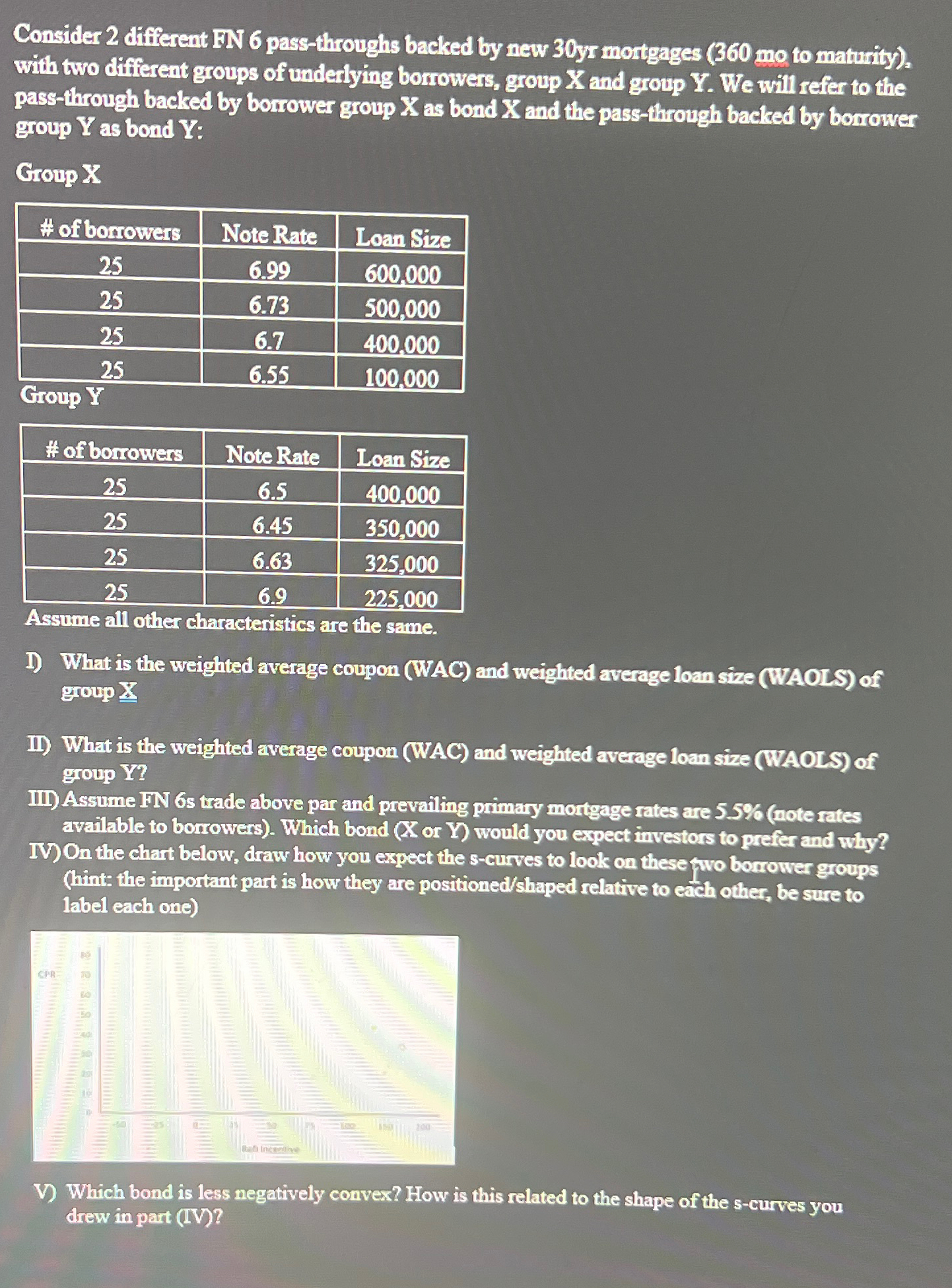

Group X

table# of borrowers,Note Rate,Loan Size

Group Y

table# of bomrowers,Note Rate,Loan Size

Assume all other characteristics are the same.

I What is the weighted average coupon WAC and weighted average loan size WAOLS of group X

II What is the weighted average coupon WAC and weighted average loan size WAOLS of group

III Assume IN trade above par and prevailing primary mortgage rates are note rates available to borrowers Which bond or would you expect investors to prefer and why?

IV On the chart below, draw how you expect the scurves to look on these fivo borrower groups hint: the important part is how they are positionedshaped relative to each other, be sure to label each one

V Which bond is less negatively convex? How is this related to the shape of the scurves you drew in part IV

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock