Question: Consider 3 payment schedules (3 loans) - (i) pay $1,000 at the end of the first year and $1,000 at the end of the second

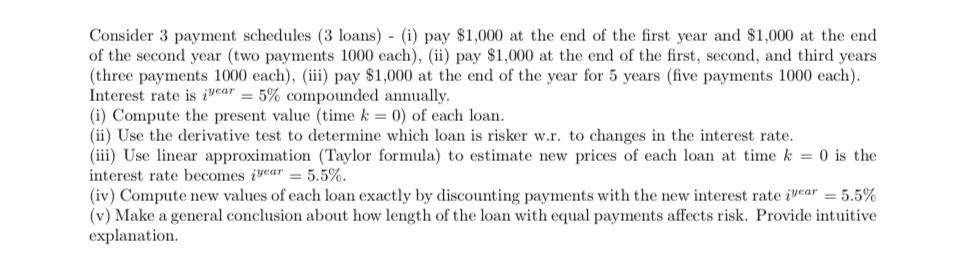

Consider 3 payment schedules (3 loans) - (i) pay $1,000 at the end of the first year and $1,000 at the end of the second year (two payments 1000 each), (ii) pay $1,000 at the end of the first second, and third years (three payments 1000 each), (iii) pay $1,000 at the end of the year for 5 years (five payments 1000 each). Interest rate is year = 5% compounded annually. (i) Compute the present value (time k = 0) of each loan. (ii) Use the derivative test to determine which loan is risker w.r. to changes in the interest rate. (iii) Use linear approximation (Taylor formula) to estimate new prices of each loan at time k = 0 is the interest rate becomes year = 5.5%. (iv) Compute new values of each loan exactly by discounting payments with the new interest rate year = 5.5% (v) Make a general conclusion about how length of the loan with equal payments affects risk. Provide intuitive explanation. Consider 3 payment schedules (3 loans) - (i) pay $1,000 at the end of the first year and $1,000 at the end of the second year (two payments 1000 each), (ii) pay $1,000 at the end of the first second, and third years (three payments 1000 each), (iii) pay $1,000 at the end of the year for 5 years (five payments 1000 each). Interest rate is year = 5% compounded annually. (i) Compute the present value (time k = 0) of each loan. (ii) Use the derivative test to determine which loan is risker w.r. to changes in the interest rate. (iii) Use linear approximation (Taylor formula) to estimate new prices of each loan at time k = 0 is the interest rate becomes year = 5.5%. (iv) Compute new values of each loan exactly by discounting payments with the new interest rate year = 5.5% (v) Make a general conclusion about how length of the loan with equal payments affects risk. Provide intuitive explanation

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts