Question: Consider a 1.0-year floating rate loan with a face value of $8,000,000 and semi-annual interest payments. Hint: treat the loan as a liability. If the

Consider a 1.0-year floating rate loan with a face value of $8,000,000 and semi-annual interest payments. Hint: treat the loan as a liability. If the loan has a 4.73% cap, the value of the cap is $ Answer If the loan also has a floor at 4.7%, the value of the floor is $ Answer The value of the collar is $ Answer

Consider a 1.0-year floating rate loan with a face value of $8,000,000 and semi-annual interest payments. Hint: treat the loan as a liability. If the loan has a 4.73% cap, the value of the cap is $ Answer If the loan also has a floor at 4.7%, the value of the floor is $ Answer The value of the collar is $ Answer

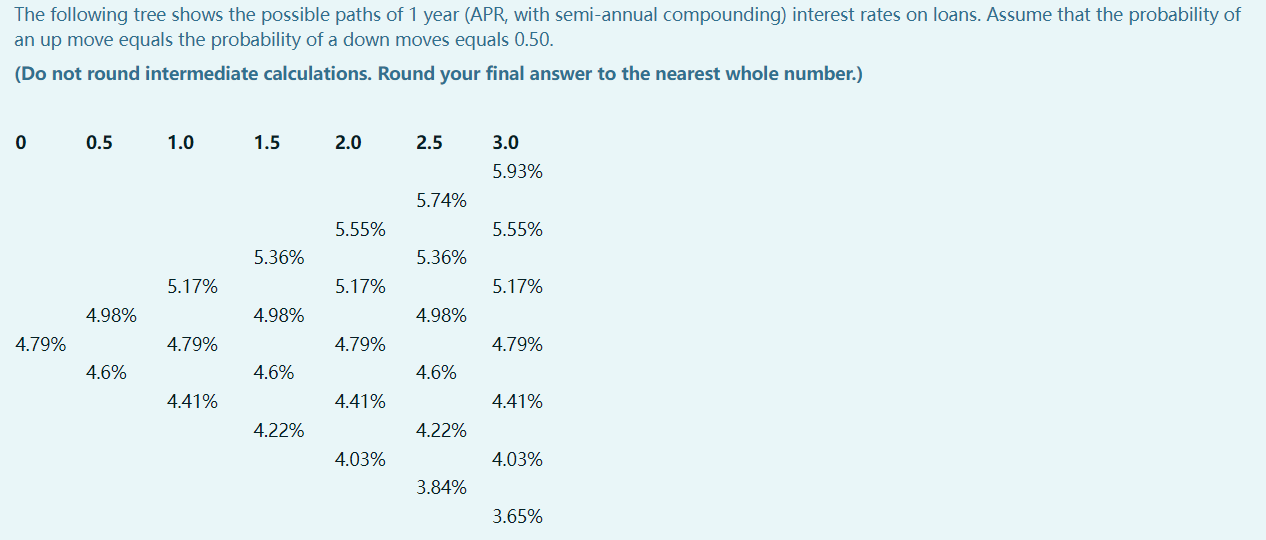

The following tree shows the possible paths of 1 year (APR, with semi-annual compounding) interest rates on loans. Assume that the probability of an up move equals the probability of a down moves equals 0.50 . (Do not round intermediate calculations. Round your final answer to the nearest whole number.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts