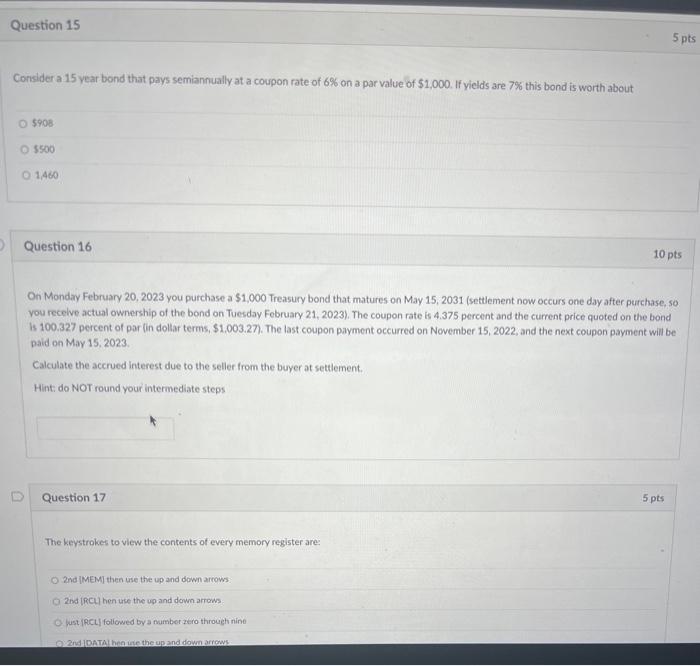

Question: Consider a 15 year bond that pays semiannually at a coupon rate of 6% on a par value of $1,000. If yields are 7% this

Consider a 15 year bond that pays semiannually at a coupon rate of 6% on a par value of $1,000. If yields are 7% this bond is worth about 5908 $500 1,460 Question 16 10pts On Monday February 20, 2023 you purchase a \$1,000 Treasury bond that matures on May 15, 2031 (settlement now occurs one day after purchase, so vou recelve actual ownership of the bond on Tuesday February 21,2023 ). The coupon rate is 4.375 percent and the current price quoted on the bond is 100.327 percent of par (in dollar terms, $1.003.27 ). The last coupon payment occurred on November 15, 2022, and the next coupon payment will be paid on May 15; 2023. Calculate the accrued interest due to the seller from the buyer at settlement. Hint: do NOT round your intermediate steps Question 17 5 pts The keystrokes to view the contents of every memory register are: 2nd IMEM] then use the up and down arrows. 2nd lReci) hen use the up and down arrows fust iRCL] followed by a number zero through nine 2nd IDATAI hen ine the up and down arrows

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts