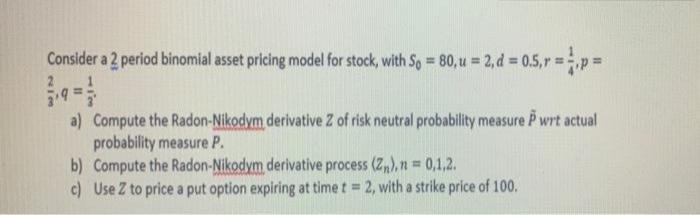

Question: Consider a 2 period binomial asset pricing model for stock, with So = 80, u = 2, d = 0.5,rp= a) Compute the Radon-Nikodym

Consider a 2 period binomial asset pricing model for stock, with So = 80, u = 2, d = 0.5,rp= a) Compute the Radon-Nikodym derivative Z of risk neutral probability measure P wrt actual probability measure P. b) Compute the Radon-Nikodym derivative process (Z), n = 0,1,2. c) Use Z to price a put option expiring at time t = 2, with a strike price of 100. %3!

Step by Step Solution

3.52 Rating (162 Votes )

There are 3 Steps involved in it

Solution Griven Decra to the pooblem we have to bionomial asset painci... View full answer

Get step-by-step solutions from verified subject matter experts