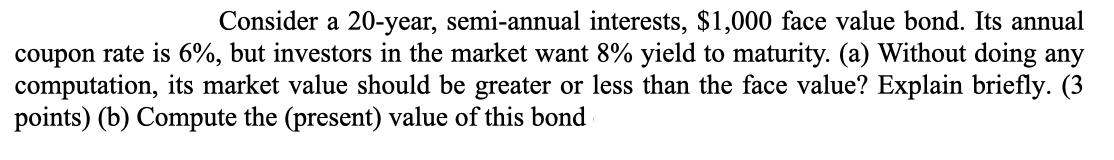

Question: Consider a 20-year, semi-annual interests, $1,000 face value bond. Its annual coupon rate is 6%, but investors in the market want 8% yield to

Consider a 20-year, semi-annual interests, $1,000 face value bond. Its annual coupon rate is 6%, but investors in the market want 8% yield to maturity. (a) Without doing any computation, its market value should be greater or less than the face value? Explain briefly. (3 points) (b) Compute the (present) value of this bond

Step by Step Solution

There are 3 Steps involved in it

a The market value should be less than the face value This ... View full answer

Get step-by-step solutions from verified subject matter experts